Question: Problem: State preference theory Mr. BEn has initial wealth W0=$12,000 and faces an uncertain future that he partitions into three states, S=1,S=2, and S=3. He

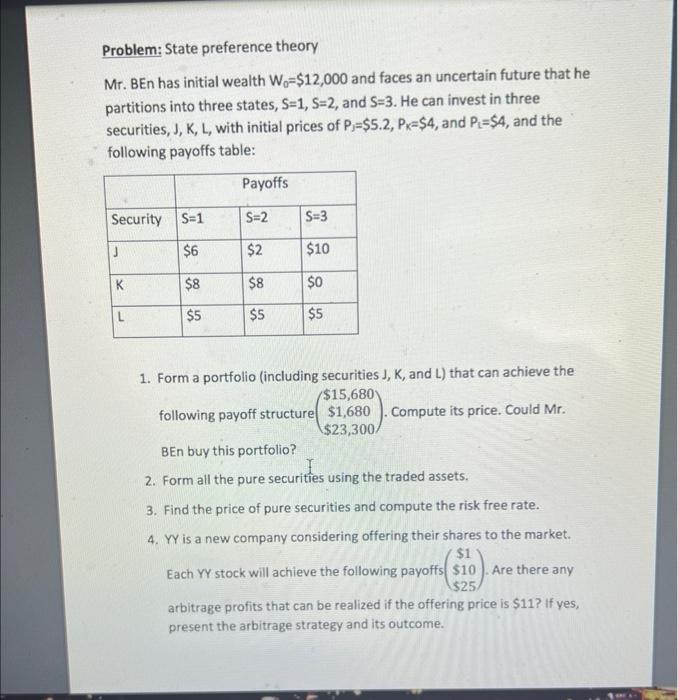

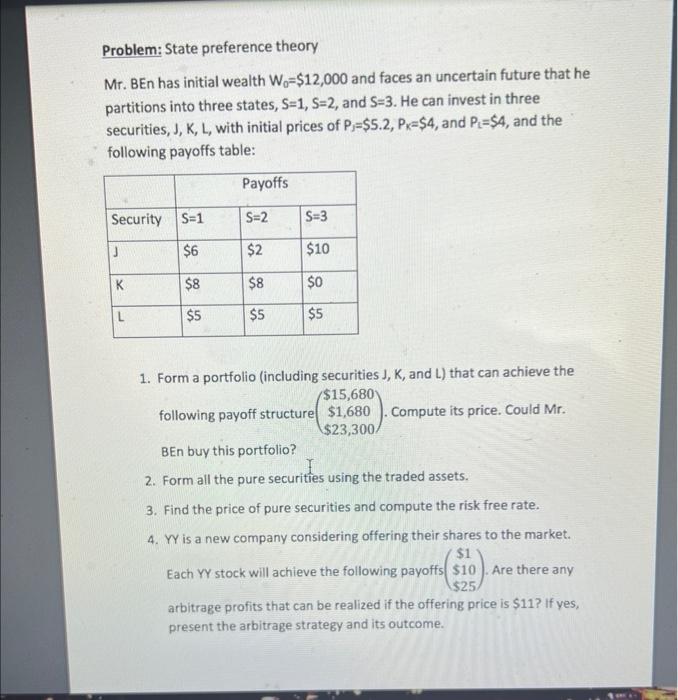

Problem: State preference theory Mr. BEn has initial wealth W0=$12,000 and faces an uncertain future that he partitions into three states, S=1,S=2, and S=3. He can invest in three securities, J, K, L, with initial prices of Pf=$5.2,PK=$4, and PL=$4, and the following payoffs table: 1. Form a portfolio (including securities J,K, and L ) that can achieve the following payoff structure $15,680$1,680$23,300. Compute its price. Could Mr. BEn buy this portfolio? 2. Form all the pure securities using the traded assets. 3. Find the price of pure securities and compute the risk free rate. 4. YY is a new company considering offering their shares to the market. Each YY stock will achieve the following payoffs $1$10$25. Are there any arbitrage profits that can be realized if the offering price is $11 ? If yes, present the arbitrage strategy and its outcome. Problem: State preference theory Mr. BEn has initial wealth W0=$12,000 and faces an uncertain future that he partitions into three states, S=1,S=2, and S=3. He can invest in three securities, J, K, L, with initial prices of Pf=$5.2,PK=$4, and PL=$4, and the following payoffs table: 1. Form a portfolio (including securities J,K, and L ) that can achieve the following payoff structure $15,680$1,680$23,300. Compute its price. Could Mr. BEn buy this portfolio? 2. Form all the pure securities using the traded assets. 3. Find the price of pure securities and compute the risk free rate. 4. YY is a new company considering offering their shares to the market. Each YY stock will achieve the following payoffs $1$10$25. Are there any arbitrage profits that can be realized if the offering price is $11 ? If yes, present the arbitrage strategy and its outcome. Problem: State preference theory Mr. BEn has initial wealth W0=$12,000 and faces an uncertain future that he partitions into three states, S=1,S=2, and S=3. He can invest in three securities, J, K, L, with initial prices of Pf=$5.2,PK=$4, and PL=$4, and the following payoffs table: 1. Form a portfolio (including securities J,K, and L ) that can achieve the following payoff structure $15,680$1,680$23,300. Compute its price. Could Mr. BEn buy this portfolio? 2. Form all the pure securities using the traded assets. 3. Find the price of pure securities and compute the risk free rate. 4. YY is a new company considering offering their shares to the market. Each YY stock will achieve the following payoffs $1$10$25. Are there any arbitrage profits that can be realized if the offering price is $11 ? If yes, present the arbitrage strategy and its outcome. Problem: State preference theory Mr. BEn has initial wealth W0=$12,000 and faces an uncertain future that he partitions into three states, S=1,S=2, and S=3. He can invest in three securities, J, K, L, with initial prices of Pf=$5.2,PK=$4, and PL=$4, and the following payoffs table: 1. Form a portfolio (including securities J,K, and L ) that can achieve the following payoff structure $15,680$1,680$23,300. Compute its price. Could Mr. BEn buy this portfolio? 2. Form all the pure securities using the traded assets. 3. Find the price of pure securities and compute the risk free rate. 4. YY is a new company considering offering their shares to the market. Each YY stock will achieve the following payoffs $1$10$25. Are there any arbitrage profits that can be realized if the offering price is $11 ? If yes, present the arbitrage strategy and its outcome

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts