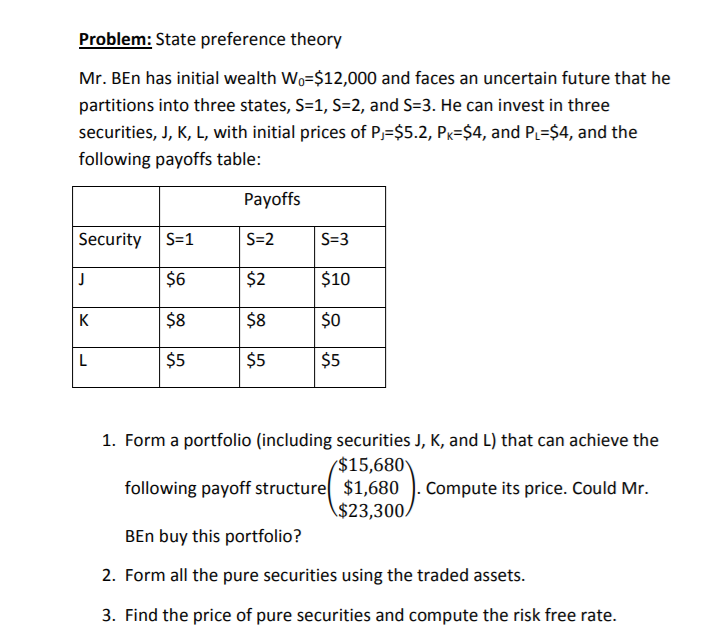

Question: Problem: State preference theory Mr. Ben has initial wealth Wo=$12,000 and faces an uncertain future that he partitions into three states, S=1, S=2, and S=3.

Problem: State preference theory Mr. Ben has initial wealth Wo=$12,000 and faces an uncertain future that he partitions into three states, S=1, S=2, and S=3. He can invest in three securities, J, K, L, with initial prices of P;=$5.2, Pr=$4, and P =$4, and the following payoffs table: Payoffs Security S=1 S=2 S=3 J $6 $2 $10 $8 $8 $0 L $5 $5 $5 1. Form a portfolio (including securities J, K, and L) that can achieve the $15,680 following payoff structure $1,680 Compute its price. Could Mr. $23,300 Ben buy this portfolio? 2. Form all the pure securities using the traded assets. 3. Find the price of pure securities and compute the risk free rate. Problem: State preference theory Mr. Ben has initial wealth Wo=$12,000 and faces an uncertain future that he partitions into three states, S=1, S=2, and S=3. He can invest in three securities, J, K, L, with initial prices of P;=$5.2, Pr=$4, and P =$4, and the following payoffs table: Payoffs Security S=1 S=2 S=3 J $6 $2 $10 $8 $8 $0 L $5 $5 $5 1. Form a portfolio (including securities J, K, and L) that can achieve the $15,680 following payoff structure $1,680 Compute its price. Could Mr. $23,300 Ben buy this portfolio? 2. Form all the pure securities using the traded assets. 3. Find the price of pure securities and compute the risk free rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts