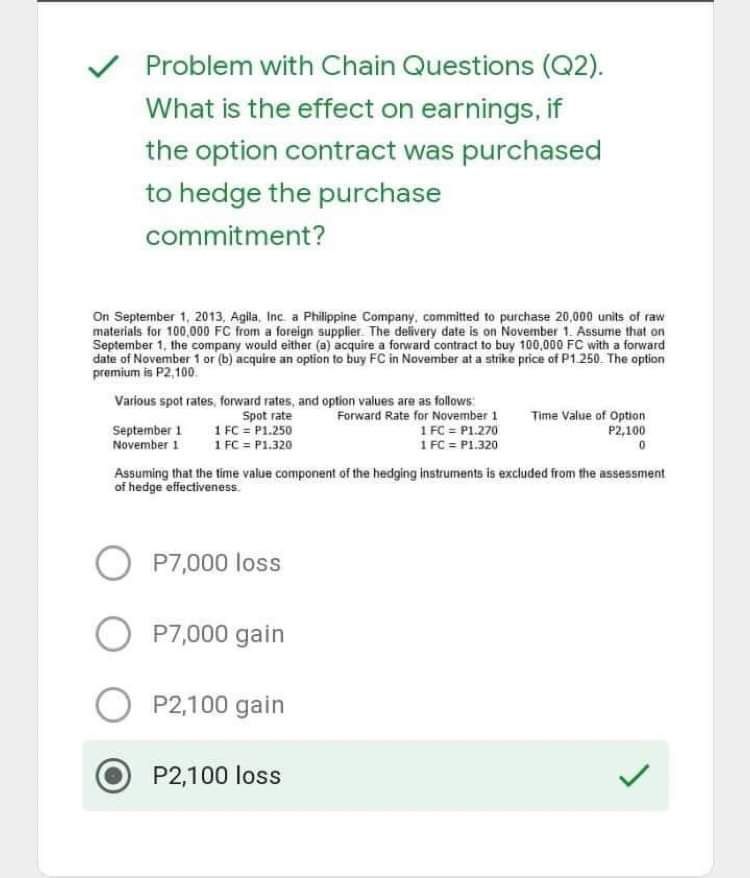

Question: Problem with Chain Questions (Q2). What is the effect on earnings, if the option contract was purchased to hedge the purchase commitment? On September 1,

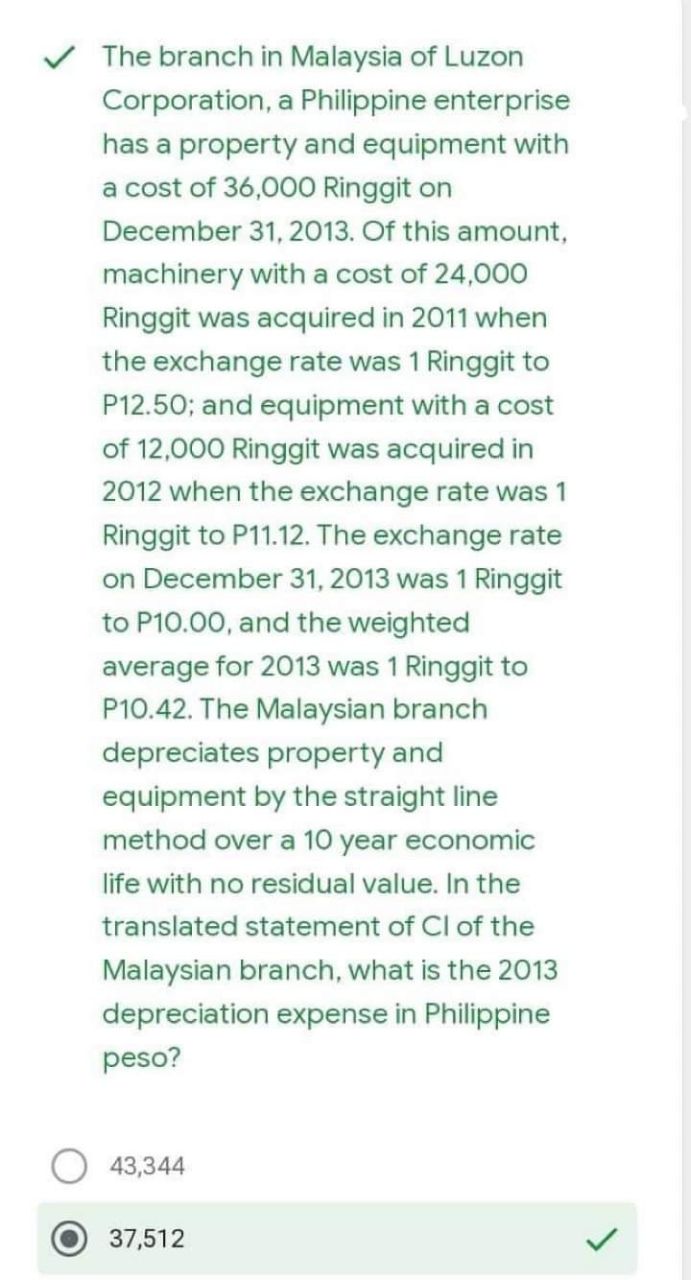

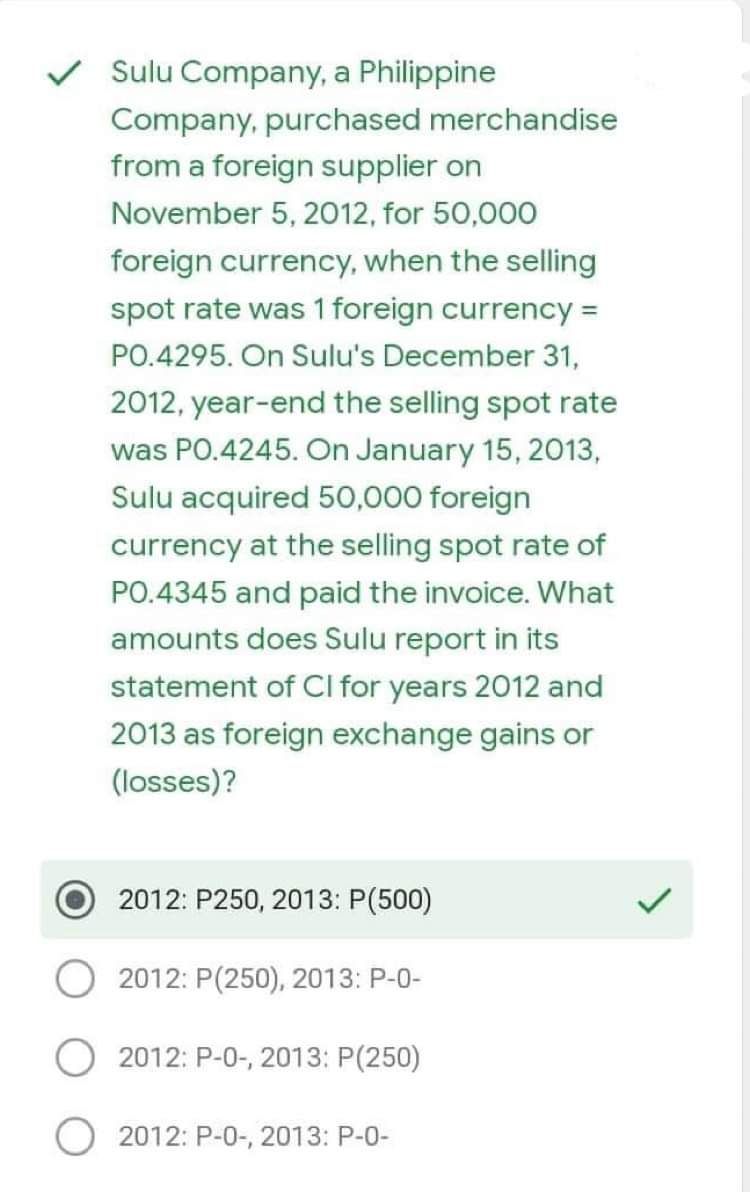

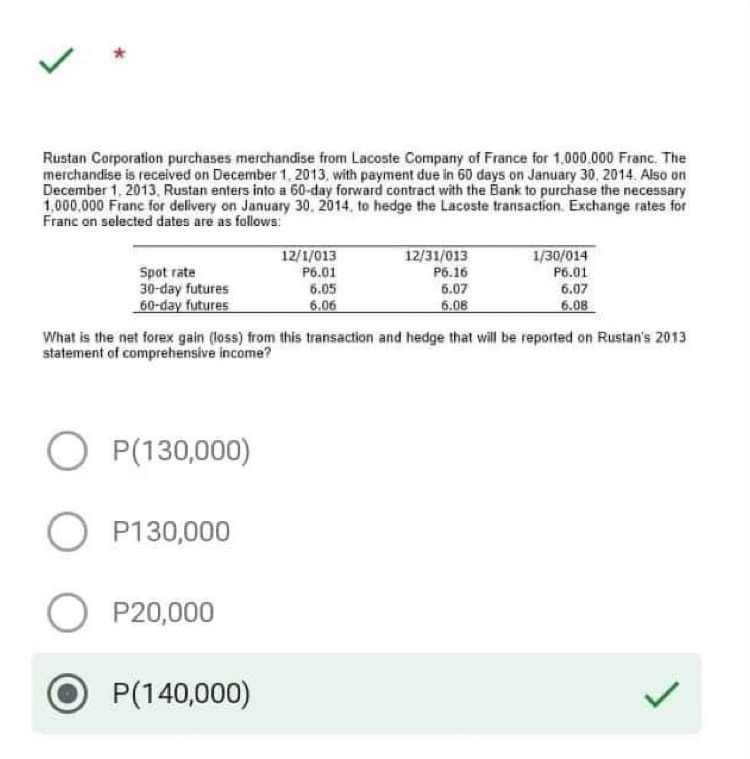

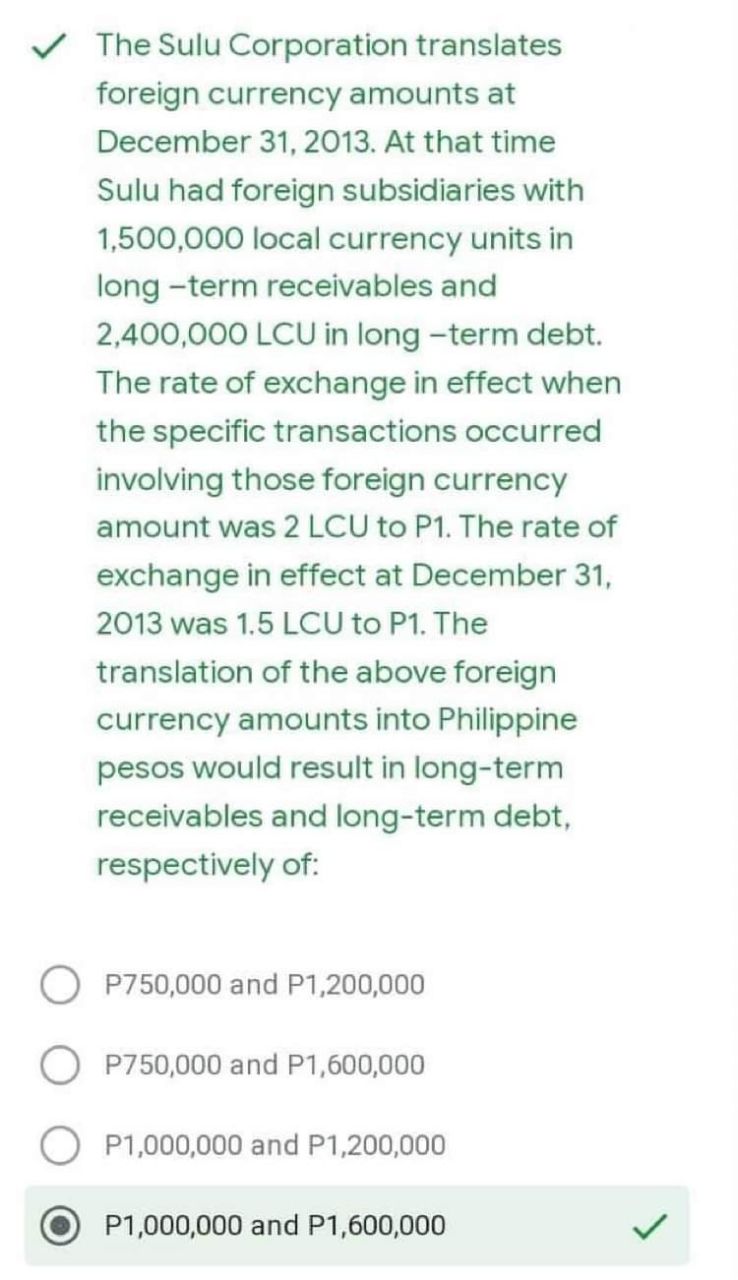

Problem with Chain Questions (Q2). What is the effect on earnings, if the option contract was purchased to hedge the purchase commitment? On September 1, 2013, Agila, Inc a Philippine Company, committed to purchase 20,000 units of raw materials for 100,000 FC from a foreign supplier. The delivery date is on November 1. Assume that on September 1, the company would either (a) acquire a forward contract to buy 100,000 FC with a forward date of November 1 or (b) acquire an option to buy FC in November at a strike price of P1 250_ The option premium is P2,100. Various spot rates, forward rates, and option values are as follows Spot rate Forward Rate for November 1 Time Value of Option September 1 1 FC = P1.250 1 FC = P1.270 P2,100 November 1 1 FC = P1.320 1 FC = P1.320 Assuming that the time value component of the hedging instruments is excluded from the assessment of hedge effectiveness P7,000 loss P7,000 gain P2,100 gain O P2,100 loss Vv' The branch in Malaysia of Luzon Corporation. a Philippine enterprise has a property and equipment with a cost of 36,000 Ringgit on December 31.2013. Of this amount. machinery with a cost of 24.000 Ringgit was acquired in 2011 when the exchange rate was 1 Ringgit to P1250: and equipment with a cost of 12,000 Ringgit was acquired in 2012 when the exchange rate was 1 Ringgit to P11.12. The exchange rate on December 31. 2013 was 1 Ringgit to P1000. and the weighted average for 2013 was 1 Ringgit to P1042. The Malaysian branch depreciates property and equipment by the straight line method over a 10 year economic life with no residual value. In the translated statement of CI of the Malaysian branch. what is the 2013 depreciation expense in Philippine peso'iI V Sulu Company, a Philippine Company, purchased merchandise from a foreign supplier on November 5, 2012, for 50,000 foreign currency, when the selling spot rate was 1 foreign currency = PO.4295. On Sulu's December 31, 2012, year-end the selling spot rate was PO.4245. On January 15, 2013, Sulu acquired 50,000 foreign currency at the selling spot rate of PO.4345 and paid the invoice. What amounts does Sulu report in its statement of CI for years 2012 and 2013 as foreign exchange gains or (losses)? O 2012: P250, 2013: P(500) V O 2012: P(250), 2013: P-0- O 2012: P-0-, 2013: P(250) O 2012: P-0-, 2013: P-0-Rustan Corporation purchases merchandise from Lacoste Company of France for 1,000.000 Franc. The merchandise is received on December 1, 2013, with payment due in 60 days on January 30, 2014. Also on December 1, 2013, Rustan enters into a 60-day forward contract with the Bank to purchase the necessary 1,000,000 Franc for delivery on January 30. 2014, to hedge the Lacoste transaction. Exchange rates for Franc on selected dates are as follows: 12/1/013 12/31/013 1/30/014 Spot rate P6.01 P6.16 P6.01 30-day futures 6.05 6.07 6.07 60-day futures 6.06 6.08 6.08 What is the net forex gain (loss) from this transaction and hedge that will be reported on Rustan's 2013 statement of comprehensive income? P(130,000) O P130,000 O P20,000 P(140,000) VThe Sulu Corporation translates foreign currency amounts at December 31, 2013. At that time Sulu had foreign subsidiaries with 1,500,000 local currency units in long-term receivables and 2,400,000 LCU in long-term debt. The rate of exchange in effect when the specific transactions occurred involving those foreign currency amount was 2 LCU to P1. The rate of exchange in effect at December 31, 2013 was 1.5 LCU to P1. The translation of the above foreign currency amounts into Philippine pesos would result in long-term receivables and long-term debt, respectively of: P750,000 and P1,200,000 P750,000 and P1,600,000 P1,000,000 and P1,200,000 O P1,000,000 and P1,600,000 V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts