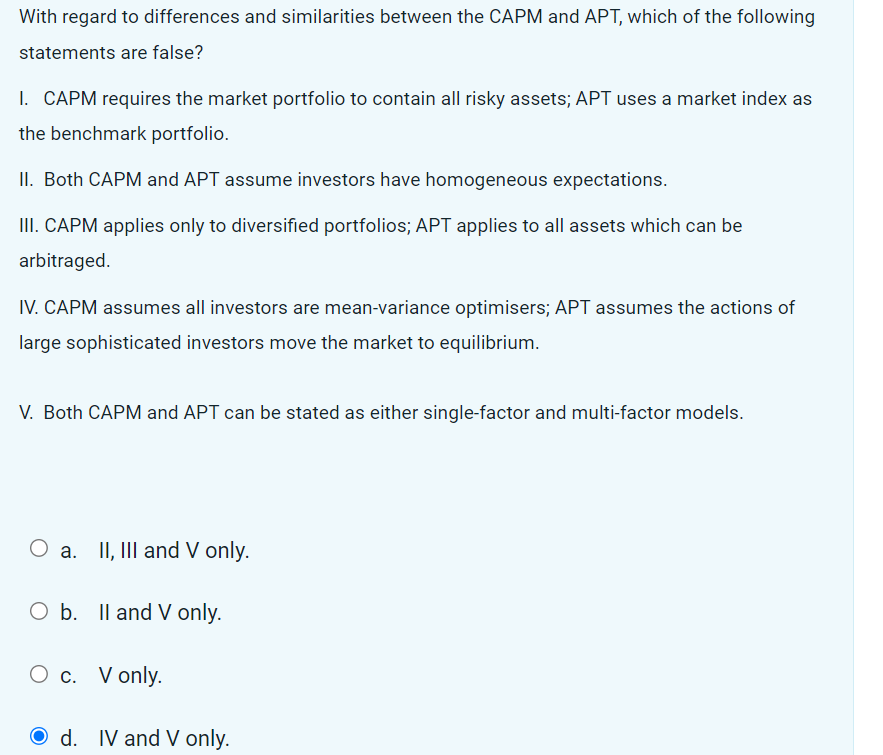

Question: With regard to differences and similarities between the CAPM and APT, which of the following statements are false? I. CAPM requires the market portfolio to

With regard to differences and similarities between the CAPM and APT, which of the following statements are false? I. CAPM requires the market portfolio to contain all risky assets; APT uses a market index as the benchmark portfolio. ||. Both CAPM and APT assume investors have homogeneous expectations. I\". CAPM applies only to diversified portfolios; APT applies to all assets which can be arbitraged. I'v'. CAPlvl assumes all investors are mean-variance optimisers; APT assumes the actions of large sophisticated investors move the market to equilibrium. V. Both CAPlvl and APT can be stated as either singlefactor and multifactor models. 0 a. II, III and V only. 0 b. H and V only. 0 c. V only. C]. IV and V only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts