Question: Problem#6: Consider three 5 year bonds, each bond has a face value of $100. All bonds mature on the same date. All bonds pay annual

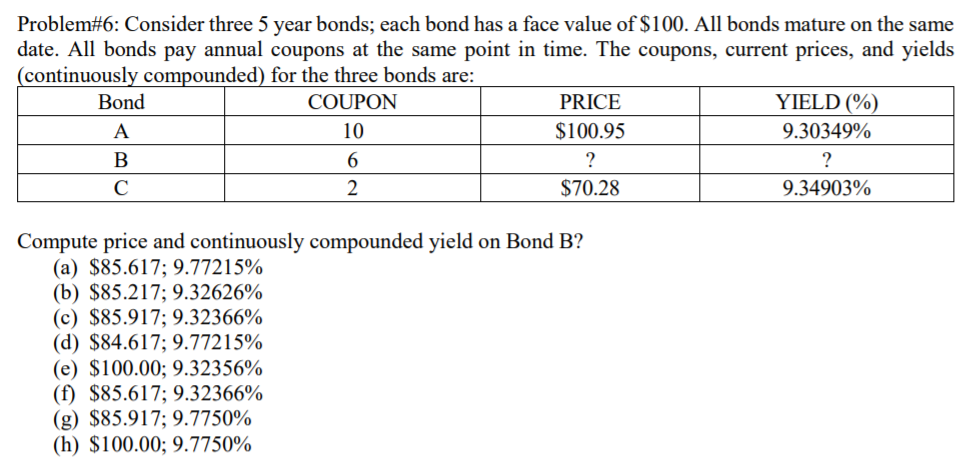

Problem#6: Consider three 5 year bonds, each bond has a face value of $100. All bonds mature on the same date. All bonds pay annual coupons at the same point in time. The coupons, current prices, and yields (continuously compounded) for the three bonds are: Bond COUPON PRICE YIELD (%) A 10 $100.95 9.30349% B 6 2 $70.28 9.34903% ? C Compute price and continuously compounded yield on Bond B? (a) $85.617; 9.77215% (b) $85.217; 9.32626% (c) $85.917; 9.32366% (d) $84.617; 9.77215% (e) $100.00; 9.32356% (f) $85.617; 9.32366% (g) $85.917; 9.7750% (h) $100.00; 9.7750%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts