Question: Procedure please! B is the correct answer 16. Mike plans to retire in 35 years and wants to be able to withdraw $50,000 at the

Procedure please!

Procedure please!

B is the correct answer

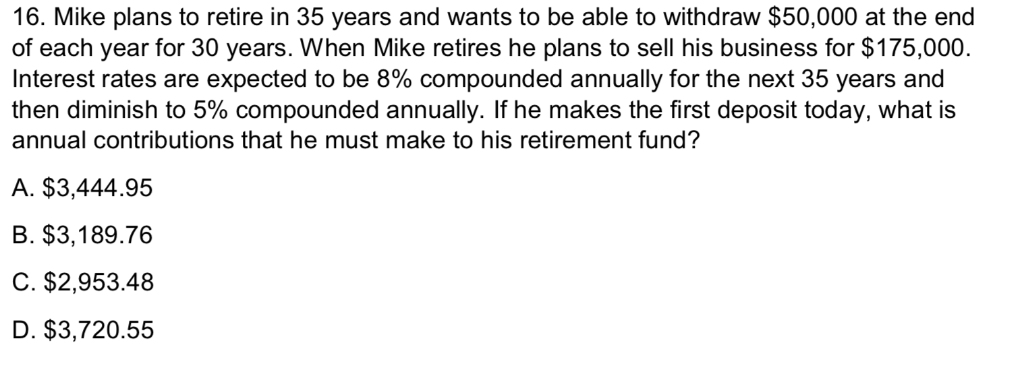

16. Mike plans to retire in 35 years and wants to be able to withdraw $50,000 at the end of each year for 30 years. When Mike retires he plans to sell his business for $175,000. Interest rates are expected to be 8% compounded annually for the next 35 years and then diminish to 5% compounded annually. If he makes the first deposit today, what is annual contributions that he must make to his retirement fund? A. $3,444.95 B. $3,189.76 C. $2,953.48 D. $3,720.55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts