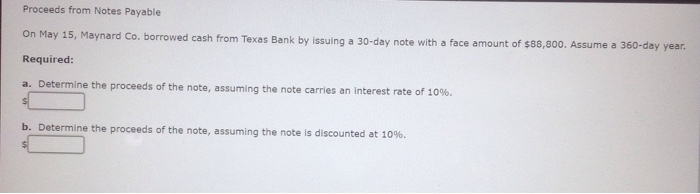

Question: Proceeds from Notes Payable On May 15, Maynard Co. borrowed cash from Texas Bank by issuing a 30-day note with a face amount of $88,800.

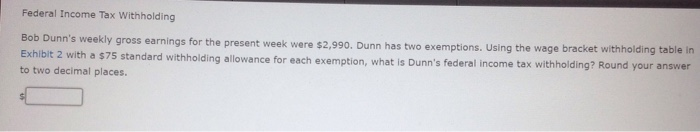

Proceeds from Notes Payable On May 15, Maynard Co. borrowed cash from Texas Bank by issuing a 30-day note with a face amount of $88,800. Assume a 360-day year. Required: a. Determine the proceeds of the note, assuming the note carries an interest rate of 10%. b. Determine the proceeds of the note, assuming the note is discounted at 10%. Federal Income Tax Withholding Bob Dunn's weekly gross earnings for the present week were $2,990. Dunn has two exemptions. Using the wage bracket withholding table in Exhibit 2 with a $75 standard withholding allowance for each exemption, what is Dunn's federal income tax withholding? Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts