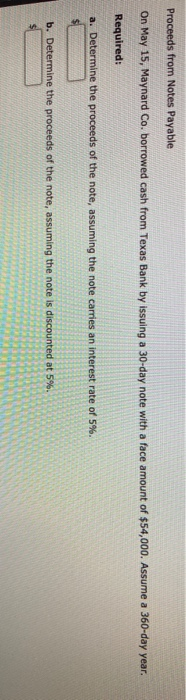

Question: Proceeds from Notes Payable On May 15, Maynard Co. borrowed cash from Texas Bank by issuing a 30-day note with a face amount of $54,000.

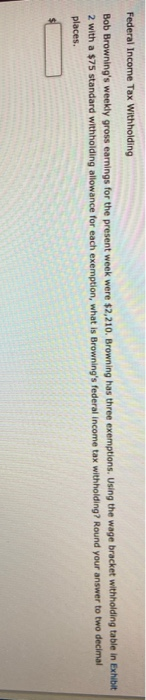

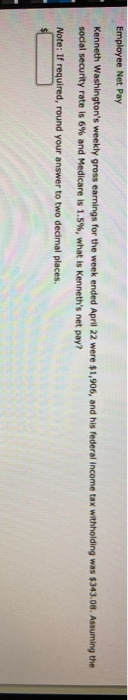

Proceeds from Notes Payable On May 15, Maynard Co. borrowed cash from Texas Bank by issuing a 30-day note with a face amount of $54,000. Assume a 360-day year. Required: a. Determine the proceeds of the note, assuming the note carries an interest rate of 5%. b. Determine the proceeds of the note, assuming the note is discounted at 5%. Federal Income Tax Withholding Bob Browning's weekly gross earnings for the present week were $2,210. Browning has three exemptions. Using the wage bracket withholding table in Exhibit 2 with a $75 standard withholding allowance for each exemption, what is Browning's federal income tax withholding? Round your answer to two decimal places. Employee Net Pay Kenneth Washington's weekly gross earnings for the week ended April 22 were $1,906, and his federal income tax withholding was $343.08. Assuming the social security rate is 6% and Medicare is 1.5%, what is Kenneth's net pay? Note: If required, round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts