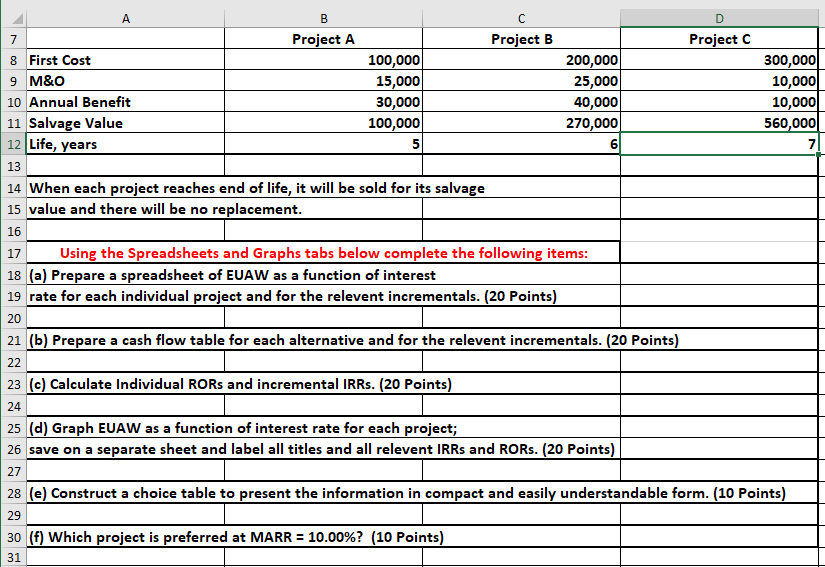

Question: Project A Project B Project 8 First Cost 9 M&O 10 Annual Benefit 11 Salvage Value 12 Life, years 13 14 When each project reaches

Project A Project B Project 8 First Cost 9 M&O 10 Annual Benefit 11 Salvage Value 12 Life, years 13 14 When each project reaches end of life, it will be sold for its salvage 100,000 15,000 30,000 100,000 200,000 25,000 40,000 270,000 6 300,000 10,000 10,000 560,000 7 15 value and there will be no replacement 16 17 18 (a) Prepare a spreadsheet of EUAW as a function of interest 19 rate for each individual project and for the relevent incrementals. (20 Points) 20 21 (b) Prepare a cash flow table for each alternative and for the relevent incrementals. (20 Points Using the Spreadsheets and Graphs tabs below complete the following items 23 (c) Calculate Individual RORs and incremental IRRs. (20 Points) 25 (d) Graph EUAW as a function of interest rate for each project; 26 save on a separate sheet and label all titles and all relevent IRRs and RORs. (20 Points) 27 28 (e) Construct a choice table to present the information in compact and easily understandable form. (10 Points) 29 30 (f) Which project is preferred at MARRS 10.00%? (10 Points) 31 Project A Project B Project 8 First Cost 9 M&O 10 Annual Benefit 11 Salvage Value 12 Life, years 13 14 When each project reaches end of life, it will be sold for its salvage 100,000 15,000 30,000 100,000 200,000 25,000 40,000 270,000 6 300,000 10,000 10,000 560,000 7 15 value and there will be no replacement 16 17 18 (a) Prepare a spreadsheet of EUAW as a function of interest 19 rate for each individual project and for the relevent incrementals. (20 Points) 20 21 (b) Prepare a cash flow table for each alternative and for the relevent incrementals. (20 Points Using the Spreadsheets and Graphs tabs below complete the following items 23 (c) Calculate Individual RORs and incremental IRRs. (20 Points) 25 (d) Graph EUAW as a function of interest rate for each project; 26 save on a separate sheet and label all titles and all relevent IRRs and RORs. (20 Points) 27 28 (e) Construct a choice table to present the information in compact and easily understandable form. (10 Points) 29 30 (f) Which project is preferred at MARRS 10.00%? (10 Points) 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts