Question: Project Instructions: Project Paramaters Your clients are Ted and Cheyanne Jackson. They engage with you to complete their 2021 individual tax refurn and provide you

Project Instructions:

Project Instructions:

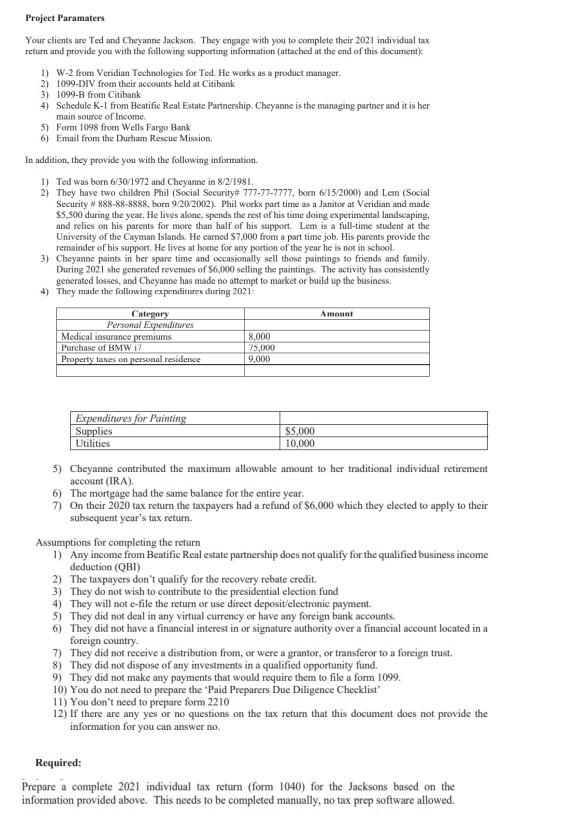

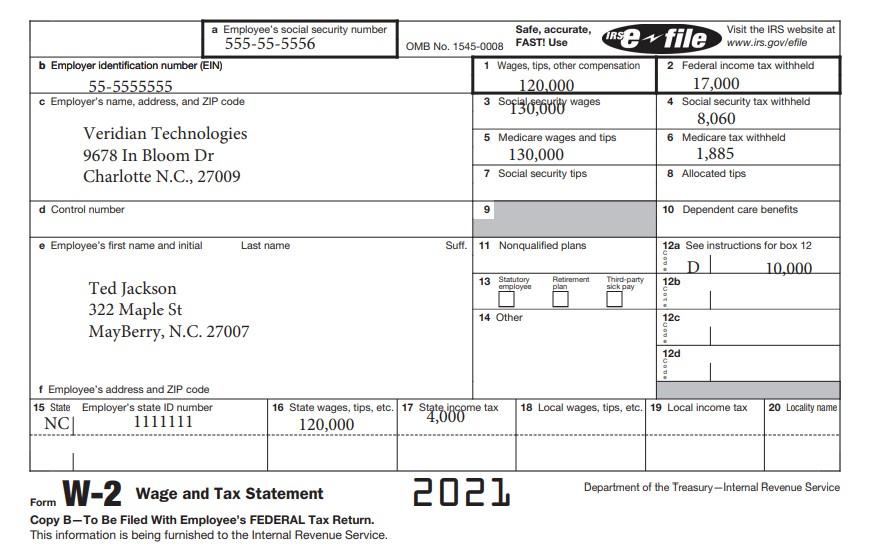

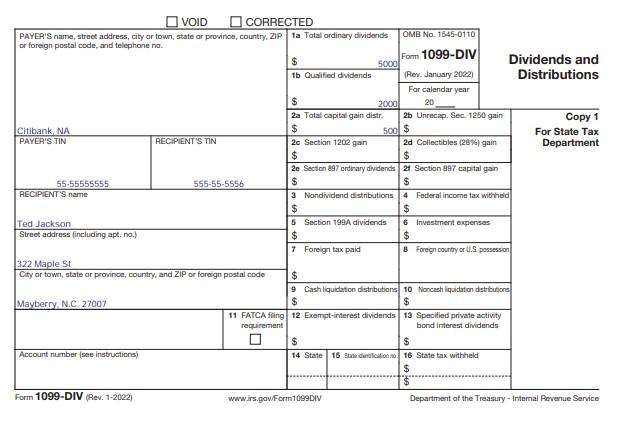

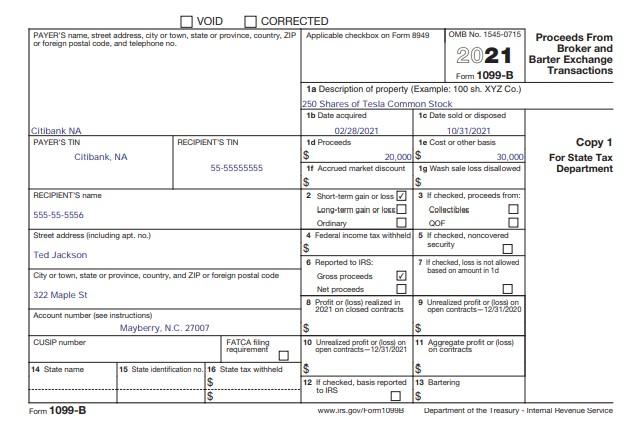

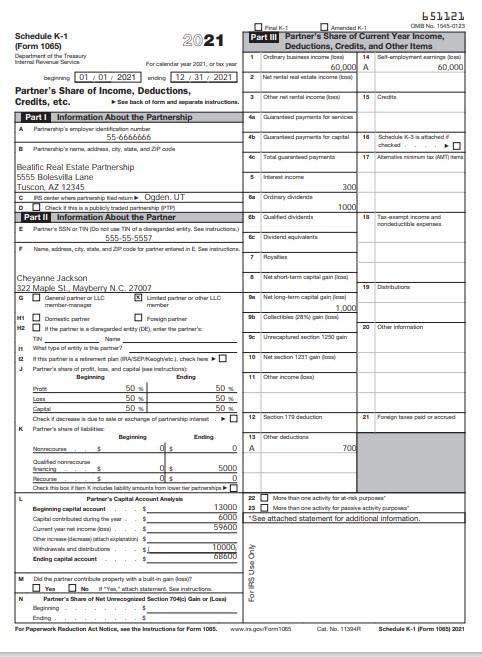

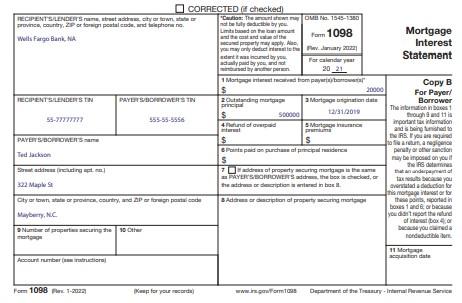

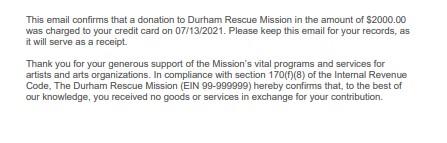

Project Paramaters Your clients are Ted and Cheyanne Jackson. They engage with you to complete their 2021 individual tax refurn and provide you with the following supporting information (attached at the end of this document): 1) W-2 from Veridian Technologies for Ted. He works as a product manager. 2) 1099-DIV from their accounts held at Citibank 3) 1099-B from Citibank 4) Schedule K-1 from Beatific Real Estate Partnership. Cheyanne is the managing partner and it is ber main source of Income. 5) Fortu 1098 from Wells Fargo Bank 6) Email from the Durtam Rescue Mission. In addition, they provide you with the following information. 1) Ted was born 6/30/1972 and Cheyanne in 8/2/198I. 2) They have two children Phil (Social Security\# 777-77-7777, boon 6/15/2000) and Lem (Social Security \# 888-88-8888, born 9/20/2002). Phil works part time as a Janitor at Veridan and made \$5,500 during the year. He lives alone, spends the rest of his time doing experimental landseaping, and relies on his parents for more than half of his support. Lem is a full-time student at the University of the Cayman Islands. He earned $7,000 from a part time job. His parents provide the remainder of his support. He lives at home for any portion of the year he is not in school. 3) Cheyanne paints in ber spare time and occasionally sell those paintings to friends and family. During 2021 she generated revenues of $6,000 selling the paintings. The activity has consistently genecated losses, and Cheyanne has made no attempt to market or build up the business. 4) They made the following expenditures during 2021 : 5) Cheyanne contributed the maximum allowable amount to her traditional individual retirement account (IRA). 6) The mortgage had the same balance for the entire year. 7) On their 2020 tax return the taxpayers had a refund of $6,000 which they elected to apply to their subsequent year's tax return. Assumptions for completing the return 1) Any income from Beatific Real estate partnership does not qualify for the qualified business income deduction (QBI) 2) The taxpayers don't qualify for the recovery rebate credit. 3) They do not wish to contribute to the presidential election fund 4) They will not e-file the return or use direct deposit/electronic payment. 5) They did not deal in any virtual currency or have any foreign bank accounts. 6) They did not have a financial interest in or signature authority over a financial account located in a foreign country. 7) They did not receive a distribution from, or were a grantor, or transferor to a forcign trust. 8) They did not dispose of any investments in a qualified opportunity fund. 9) They did not make any puyments that would require them to file a form 1099. 10) You do not need to prepare the 'Paid Preparers Due Diligence Checklist' 11) You don't need to prepare form 2210 12) If there are any yes or no questions on the tax return that this document does not provide the information for you can answer no. Required: Prepare a complete 2021 individual tax return (form 1040) for the Jacksons based on the information provided above. This needs to be completed manually, no tax prep software allowed. Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. VOID CORRECTED VOID CORRECTED COPAECTED (f checked) This email confirms that a donation to Durham Rescue Mission in the amount of $2000.00 was charged to your credit card on 07/13/2021. Please keep this email for your records, as it will serve as a receipt. Thank you for your generous support of the Mission's vital programs and services for artists and arts organizations. In compliance with section 170(f)(8) of the Internal Revenue Code, The Durham Rescue Mission (EIN 99-999999) hereby confirms that, to the best of our knowledge, you received no goods or services in exchange for your contribution. Project Paramaters Your clients are Ted and Cheyanne Jackson. They engage with you to complete their 2021 individual tax refurn and provide you with the following supporting information (attached at the end of this document): 1) W-2 from Veridian Technologies for Ted. He works as a product manager. 2) 1099-DIV from their accounts held at Citibank 3) 1099-B from Citibank 4) Schedule K-1 from Beatific Real Estate Partnership. Cheyanne is the managing partner and it is ber main source of Income. 5) Fortu 1098 from Wells Fargo Bank 6) Email from the Durtam Rescue Mission. In addition, they provide you with the following information. 1) Ted was born 6/30/1972 and Cheyanne in 8/2/198I. 2) They have two children Phil (Social Security\# 777-77-7777, boon 6/15/2000) and Lem (Social Security \# 888-88-8888, born 9/20/2002). Phil works part time as a Janitor at Veridan and made \$5,500 during the year. He lives alone, spends the rest of his time doing experimental landseaping, and relies on his parents for more than half of his support. Lem is a full-time student at the University of the Cayman Islands. He earned $7,000 from a part time job. His parents provide the remainder of his support. He lives at home for any portion of the year he is not in school. 3) Cheyanne paints in ber spare time and occasionally sell those paintings to friends and family. During 2021 she generated revenues of $6,000 selling the paintings. The activity has consistently genecated losses, and Cheyanne has made no attempt to market or build up the business. 4) They made the following expenditures during 2021 : 5) Cheyanne contributed the maximum allowable amount to her traditional individual retirement account (IRA). 6) The mortgage had the same balance for the entire year. 7) On their 2020 tax return the taxpayers had a refund of $6,000 which they elected to apply to their subsequent year's tax return. Assumptions for completing the return 1) Any income from Beatific Real estate partnership does not qualify for the qualified business income deduction (QBI) 2) The taxpayers don't qualify for the recovery rebate credit. 3) They do not wish to contribute to the presidential election fund 4) They will not e-file the return or use direct deposit/electronic payment. 5) They did not deal in any virtual currency or have any foreign bank accounts. 6) They did not have a financial interest in or signature authority over a financial account located in a foreign country. 7) They did not receive a distribution from, or were a grantor, or transferor to a forcign trust. 8) They did not dispose of any investments in a qualified opportunity fund. 9) They did not make any puyments that would require them to file a form 1099. 10) You do not need to prepare the 'Paid Preparers Due Diligence Checklist' 11) You don't need to prepare form 2210 12) If there are any yes or no questions on the tax return that this document does not provide the information for you can answer no. Required: Prepare a complete 2021 individual tax return (form 1040) for the Jacksons based on the information provided above. This needs to be completed manually, no tax prep software allowed. Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. VOID CORRECTED VOID CORRECTED COPAECTED (f checked) This email confirms that a donation to Durham Rescue Mission in the amount of $2000.00 was charged to your credit card on 07/13/2021. Please keep this email for your records, as it will serve as a receipt. Thank you for your generous support of the Mission's vital programs and services for artists and arts organizations. In compliance with section 170(f)(8) of the Internal Revenue Code, The Durham Rescue Mission (EIN 99-999999) hereby confirms that, to the best of our knowledge, you received no goods or services in exchange for your contribution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts