Question: proper answer needed with full step solution 4. The figure below shows the changes in traffic volume over the years for two altemativesi Alternative-A requires

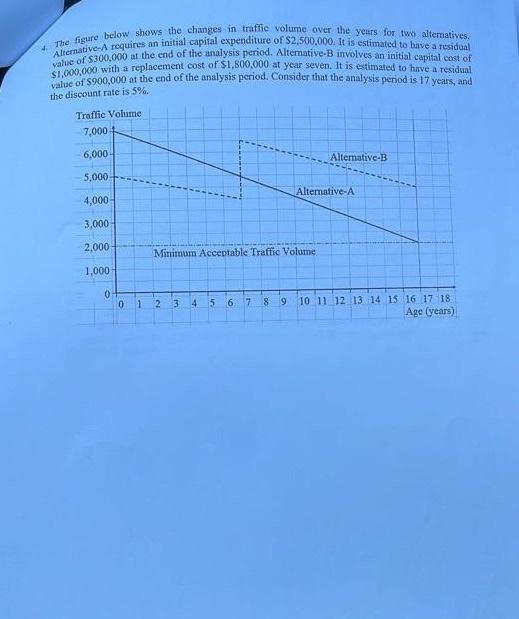

4. The figure below shows the changes in traffic volume over the years for two altemativesi Alternative-A requires an initial capital expenditure of $2,500,000. It is estimated to have a residual value of 5300,000 at the end of the analysis period. Altemative-B involves an initial capital cost of $1,009,000 with a replacement cost of $1,800,000 at year seven. It is estimated to hrve a residual value of $900,000 at the end of the analysis period. Consider that the analysis period is 17 years, and the discount rate is 5%. Retcmine which alternative is economically virble by compating the two ilfernatives bused eolely on the agency costs and the residual values of the alternatives over the analysis pered using a present worth method. (18 points) and 2) - for each alternative are considered, it is assumed th and the IRR of Altemative-B is 13.7\%. Determineinvesmeat, considering the IRRs of Altematives A decision. (77 points) 4. The figure below shows the changes in traffic volume over the years for two altemativesi Alternative-A requires an initial capital expenditure of $2,500,000. It is estimated to have a residual value of 5300,000 at the end of the analysis period. Altemative-B involves an initial capital cost of $1,009,000 with a replacement cost of $1,800,000 at year seven. It is estimated to hrve a residual value of $900,000 at the end of the analysis period. Consider that the analysis period is 17 years, and the discount rate is 5%. Retcmine which alternative is economically virble by compating the two ilfernatives bused eolely on the agency costs and the residual values of the alternatives over the analysis pered using a present worth method. (18 points) and 2) - for each alternative are considered, it is assumed th and the IRR of Altemative-B is 13.7\%. Determineinvesmeat, considering the IRRs of Altematives A decision. (77 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts