Question: Provide a Python program that prices a put option using an initial stock price of $50. The program should also calculate your breakeven stock

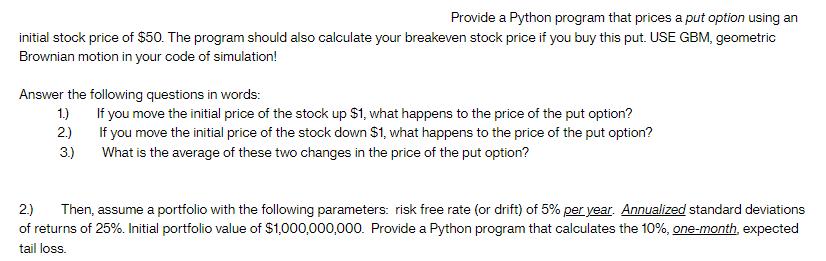

Provide a Python program that prices a put option using an initial stock price of $50. The program should also calculate your breakeven stock price if you buy this put. USE GBM, geometric Brownian motion in your code of simulation! Answer the following questions in words: 1.) 2.) 3.) If you move the initial price of the stock up $1, what happens to the price of the put option? If you move the initial price of the stock down $1, what happens to the price of the put option? What is the average of these two changes in the price of the put option? 2.) Then, assume a portfolio with the following parameters: risk free rate (or drift) of 5% per year. Annualized standard deviations of returns of 25%. Initial portfolio value of $1,000,000,000. Provide a Python program that calculates the 10%, one-month, expected tail loss.

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

To calculate the price of a put option using the geometric Brownian motion GBM model you can use the BlackScholes formula Heres a Python program to do that and answer your questions import numpy as np ... View full answer

Get step-by-step solutions from verified subject matter experts