Question: provide complete and clear solution please Key Answer: Dland = PHP 12,000 Dbuilding=php 548,440 Dmach= PHP 245,000 Straw hat Corporation, provided the following at the

provide complete and clear solution please

Key Answer:

Dland = PHP 12,000

Dbuilding=php 548,440

Dmach= PHP 245,000

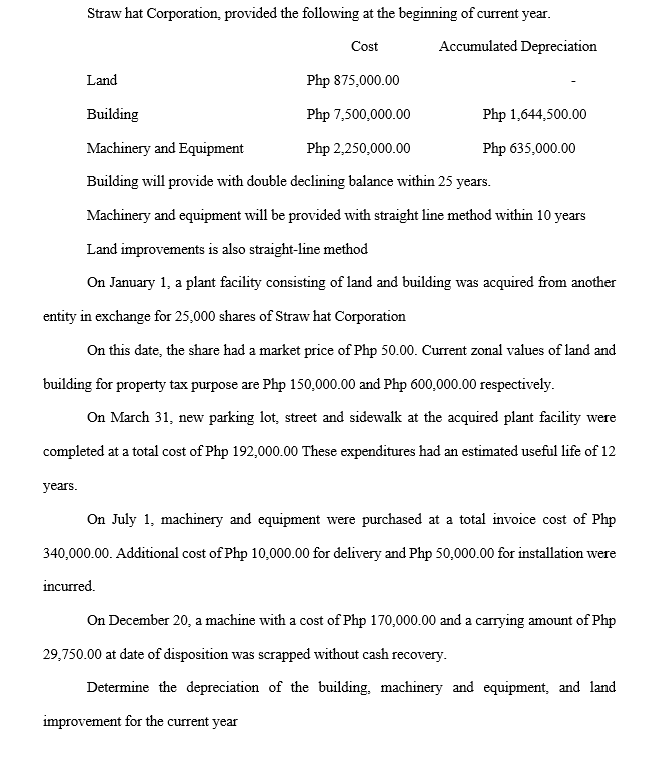

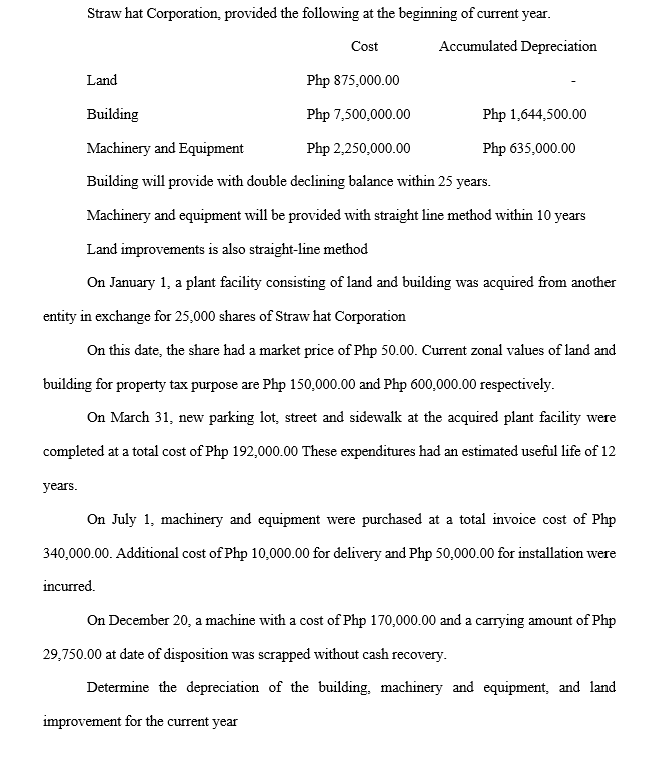

Straw hat Corporation, provided the following at the beginning of current year. Cost years. Accumulated Depreciation Land Php 875,000.00 Building Php 7,500,000.00 Machinery and Equipment Php 2,250,000.00 Building will provide with double declining balance within 25 years. Machinery and equipment will be provided with straight line method within 10 years Land improvements is also straight-line method On January 1, a plant facility consisting of land and building was acquired from another entity in exchange for 25,000 shares of Straw hat Corporation On this date, the share had a market price of Php 50.00. Current zonal values of land and building for property tax purpose are Php 150,000.00 and Php 600,000.00 respectively. On March 31, new parking lot, street and sidewalk at the acquired plant facility were completed at a total cost of Php 192,000.00 These expenditures had an estimated useful life of 12 Php 1,644,500.00 Php 635,000.00 On July 1, machinery and equipment were purchased at a total invoice cost of Php 340,000.00. Additional cost of Php 10,000.00 for delivery and Php 50,000.00 for installation were incurred. On December 20, a machine with a cost of Php 170,000.00 and a carrying amount of Php 29,750.00 at date of disposition was scrapped without cash recovery. Determine the depreciation of the building, machinery and equipment, and land improvement for the current year