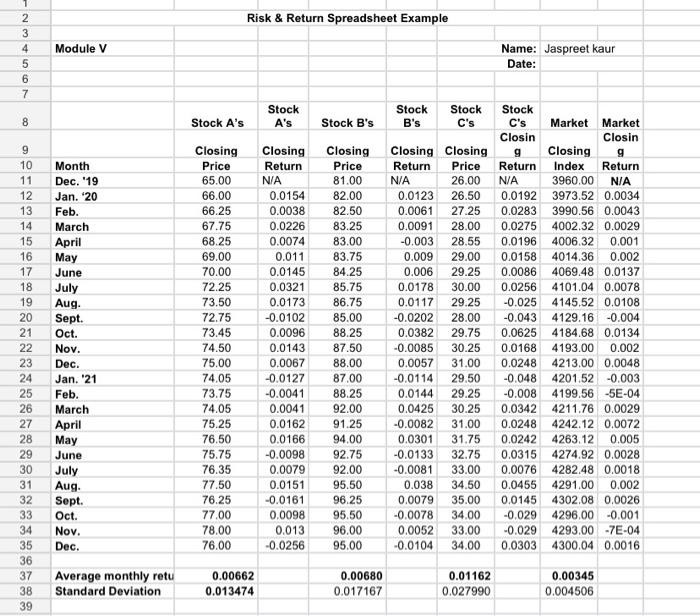

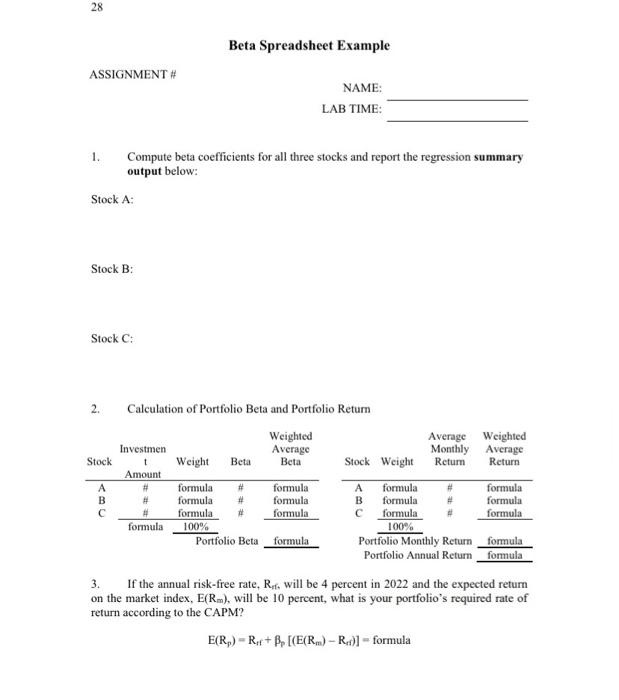

Question: provide excel 1. Compute beta coefficients for all three stocks and report the regression summary output below: Stock A: Stock B: Stock C: 2. Calculation

1. Compute beta coefficients for all three stocks and report the regression summary output below: Stock A: Stock B: Stock C: 2. Calculation of Portfolio Beta and Portfolio Retum 3. If the annual risk-free rate, Rrf, will be 4 percent in 2022 and the expected retum on the market index, E(Rm), will be 10 percent, what is your portfolio's required rate of return according to the CAPM? E(Rp)=Rtf+p[(E(Rm)Rri)]=formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts