Question: Provide more answers based on discounting, initial layout on purchase and depreciation. Zayn Transporters has determined that a new specialised delivery truck needs to be

Provide more answers based on discounting, initial layout on purchase and depreciation.

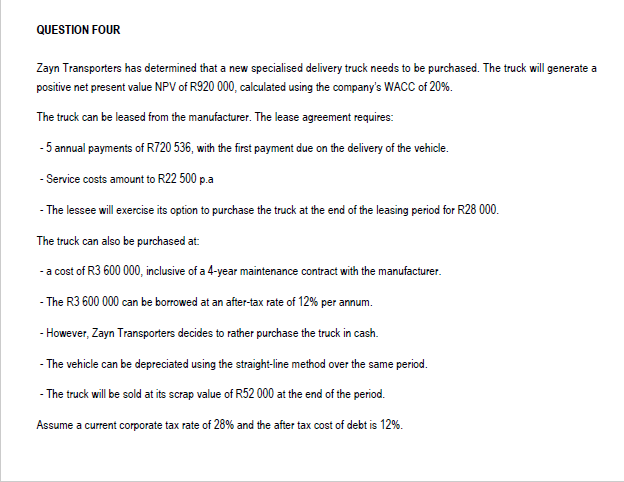

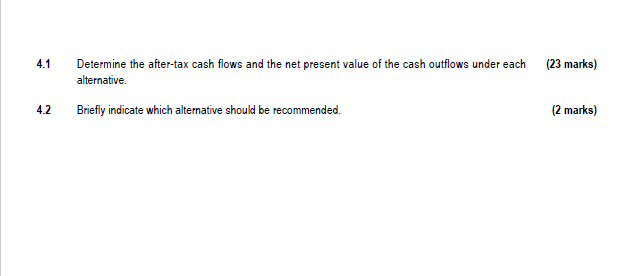

Zayn Transporters has determined that a new specialised delivery truck needs to be purchased. The truck will generate a positive net present value NPV of R920 000, calculated using the company's WACC of 20%. The truck can be leased from the manufacturer. The lease agreement requires: - 5 annual payments of R720 536, with the first payment due on the delivery of the vehicle. - Service costs amount to R22 500 p.a - The lessee will exercise its option to purchase the truck at the end of the leasing period for R28 000 . The truck can also be purchased at: - a cost of R3600000, inclusive of a 4-year maintenance contract with the manufacturer. - The R3 600000 can be borrowed at an after-tax rate of 12% per annum. - However, Zayn Transporters decides to rather purchase the truck in cash. - The vehicle can be depreciated using the straight-line method over the same period. - The truck will be sold at its scrap value of R52 000 at the end of the period. Assume a current corporate tax rate of 28% and the after tax cost of debt is 12%. 4.1 Determine the after-tax cash flows and the net present value of the cash outflows under each (23 alternative. 4.2 Briefly indicate which alternative should be recommended. Zayn Transporters has determined that a new specialised delivery truck needs to be purchased. The truck will generate a positive net present value NPV of R920 000, calculated using the company's WACC of 20%. The truck can be leased from the manufacturer. The lease agreement requires: - 5 annual payments of R720 536, with the first payment due on the delivery of the vehicle. - Service costs amount to R22 500 p.a - The lessee will exercise its option to purchase the truck at the end of the leasing period for R28 000 . The truck can also be purchased at: - a cost of R3600000, inclusive of a 4-year maintenance contract with the manufacturer. - The R3 600000 can be borrowed at an after-tax rate of 12% per annum. - However, Zayn Transporters decides to rather purchase the truck in cash. - The vehicle can be depreciated using the straight-line method over the same period. - The truck will be sold at its scrap value of R52 000 at the end of the period. Assume a current corporate tax rate of 28% and the after tax cost of debt is 12%. 4.1 Determine the after-tax cash flows and the net present value of the cash outflows under each (23 alternative. 4.2 Briefly indicate which alternative should be recommended

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts