Question: PSa 6-6 Complete Form W -2 Complete the W-2 Form for the two employees of Flywheel Outfitters Inc. (employer identification # 99- 9999999 ). Flywheel

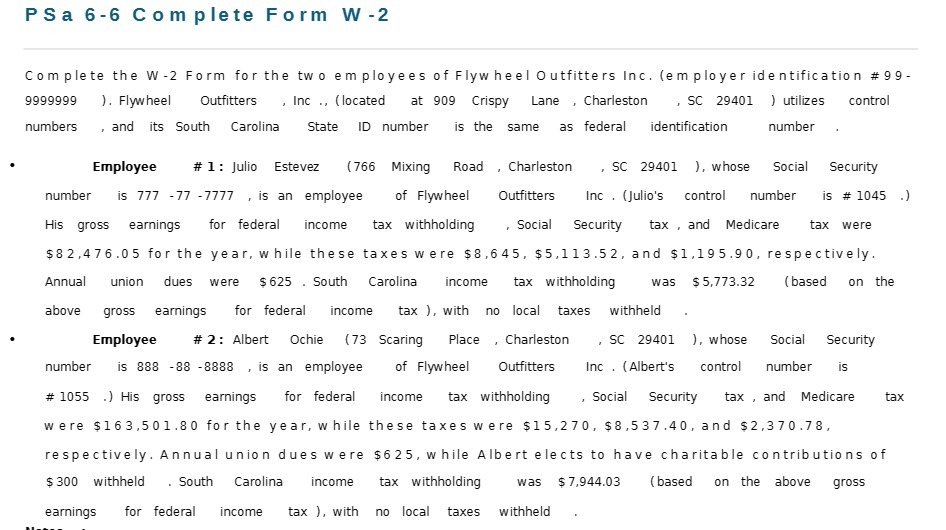

PSa 6-6 Complete Form W -2 Complete the W-2 Form for the two employees of Flywheel Outfitters Inc. (employer identification # 99- 9999999 ). Flywheel Outfitters , Inc .. (located at 909 Crispy Lane , Charleston , SC 29401 ) utilizes control numbers , and its South Carolina State ID number is the same as federal identification number Employee # 1: Julio Estevez (766 Mixing Road , Charleston , SC 29401 ), whose Social Security number is 777 -77 -7777 , is an employee of Flywheel Outfitters Inc . (Julio's control number is # 1045 .) His gross earnings for federal income tax withholding , Social Security tax , and Medicare tax were $82,476.05 for the year, while these taxes were $8,645, $5,113.52, and $1,195.90, respectively. Annual union dues were $ 625 . South Carolina income tax withholding was $ 5,773.32 ( based on the above gross earnings for federal income tax ), with no local taxes withheld Employee # 2: Albert Ochie (73 Scaring Place , Charleston , SC 29401 ), whose Social Security number is 888 -88 -8888 , is an employee of Flywheel Outfitters Inc . (Albert's control number is # 1055 .) His gross earnings for federal income tax withholding . Social Security tax , and Medicare tax were $163,501.80 for the year, while these taxes were $15,270, $8,537.40, and $2,370.78, respectively . Annual union dues were $625, while Albert elects to have charitable contributions of $ 300 withheld . South Carolina income tax withholding was $ 7,944.03 ( based on the above gross earnings for federal income tax ), with no local taxes withheld

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts