Question: PSa 6-7 Complete Form W-3 Complete the W-3 Form for Flywheel Outfitters, Inc. (employer identification #99-9899999), based on the employee information listed below. The company

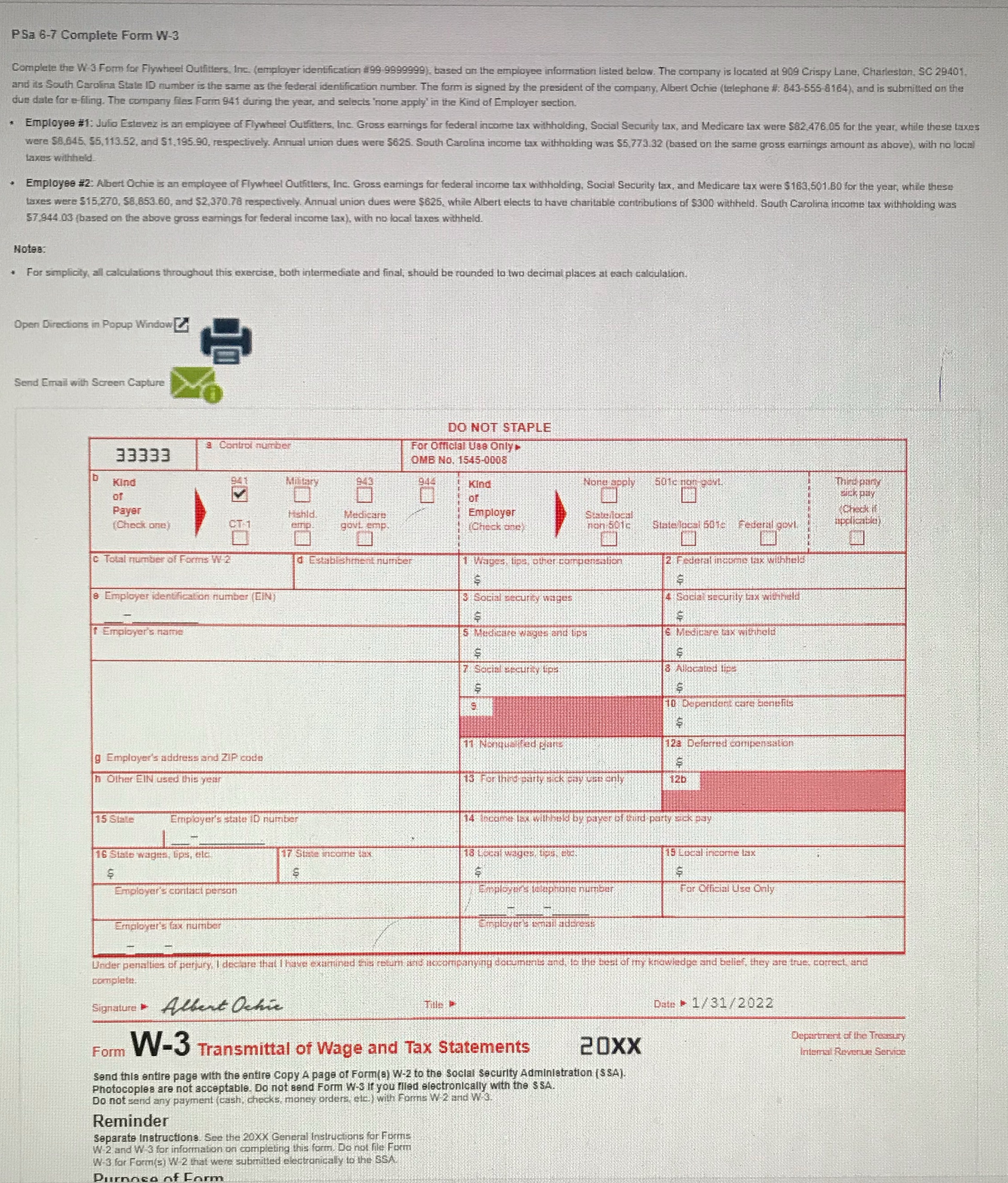

PSa 6-7 Complete Form W-3 Complete the W-3 Form for Flywheel Outfitters, Inc. (employer identification #99-9899999), based on the employee information listed below. The company is located at 909 Crispy Lane, Charleston, SC 29401 and its South Carolina State ID number is the same as the federal identification number. The form is signed by the president of the company, Albert Ochie (telephone #: 843-555-8164), and is submitted on the due date for c-filing. The company files Form 941 during the year, and selects 'none apply' in the Kind of Employer section. Employee #1: Julia Estevez is an en ers, Inc. Gross ings for federal inco withholding, Social Security tax, and Medicare tax were $82 476.05 for the year, while these taxes were $8.645. $5,113.52, and $1, 195.90, resp were $625. South Can withholding was $5,773.32 (based on the same gross earnings amount as above), with no local laxes Employee #2: Albert Ochie is an er hiplayer of Flywheel Outfitters, Inc. Gross earnings for federal income tax withholding, Social Security lax, and Medicare tax were $163,501.80 for the year, while these taxes were $15,270, 58,853.60, and $2,370.78 respectively. Annual union dues were $625, while Albert elects to have charitable contributions of $300 withheld. South Carolina income tax withholding was 57.844 03 ( based on the above gross earnings for federal income tax), with no local taxes withheld. Notes. For simplicity, all calculati mediate and final, should be rounded to two decimal places at each calculation. Open Directions in Popup Window Send Email with Screen Capture DO NOT STAPLE EEEEE 2 Control number For Official Use Only OMB No. 1545-0008 Kind Military 944 King None apph hit pan of Paye Hishid. Medicare Employer Sisbe local Check If (Check one) Ovt emp (Check can State local 501- Federal gout C Total number of Ferns W 2 d Establishme 1 wages, ties, einer compensation 2 Federal income tax withheld e Employer identification number (EIN) 3 Social securty wages Social security lax sitineld 1 Employer's name s Medicare Wages and lips E Medicare tax withheld 3 Allocated lips S 0 Dependent care acnelite 23 Deferred compensation g Employer's address and ZIP code Other EIN used this year E For thes party pick any was only 12b 15 State Employer's state ID number 14 loccimpe las with bake by payer of and party sick pay 16 State wages, ups, ala 17 State income tax 15 Local income lax S Employer's contact person For Official Use Only Employers fax number Gralevery email address Under penallies of perjury, I des are that I have examined the return and accompanying documents and, le the best of my krawledge and belief, they are true, correct ane complete. Signature Albert Ochie Date . 1/31/2022 Form W-3 Transmittal of Wage and Tax Statements 20XX department of the Treasury Intemal Revenue Service Send this entire page with the entire Copy A page of Form(s) W-2 to the social security Administration ( $ SA). Photocopies are not acceptable. Do not send Form W-S If you filed electronically with the $ SA. Do not send any payment (cash, checks, money orders, etc. ) with Forms W 2 and W.3. Reminder Separate Instructions. See the 20XX General Instructions for Forme W-2 and W 3 for information on completing this form. Do not file Form W-3 for Form(s) W-2 that were submitted electronically to the SSA