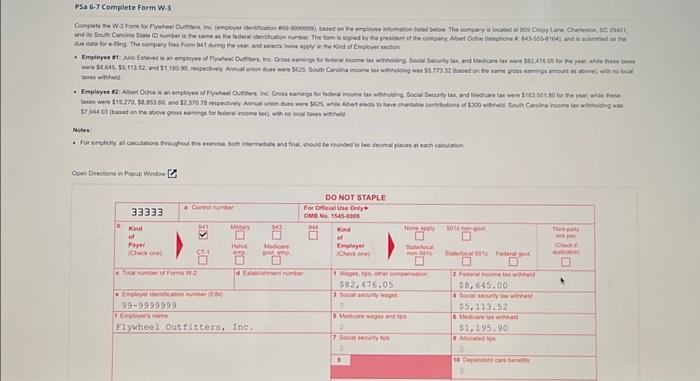

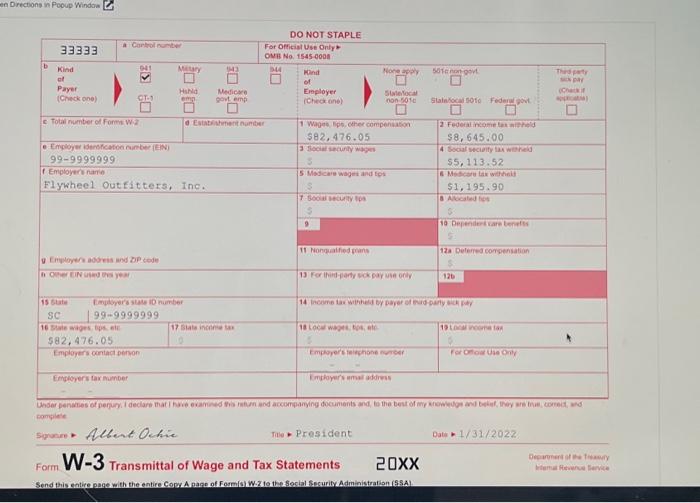

PSa 6-7 Complete Form W-3 Complete the W-3 Form for Flywheel Outfitters, Inc. (employer identification #99-9999999), based on the employee information listed below. The company is located at 909 Crispy Lane, Charleston, SC 29401, and its South Carolina State ID number is the same as the federal identification number. The form is signed by the president of the company, Albert Ochie (telephone #: 843-555-8164), and is submitted on the due date for e-filing. The company files Form 941 during the year, and selects 'none apply in the Kind of Employer section. . Employee # 1: Julio Estevez is an employee of Flywheel Outfitters, Inc. Gross earnings for federal income tax withholding, Social Security tax, and Medicare tax were $82,476.05 for the year, while these taxes were $8,645, $5,113.52, and $1,195.90, respectively. Annual union dues were $625. South Carolina income tax withholding was $5,773.32 (based on the same gross earnings amount as above), with no local taxes withheld. Employee #2: Albert Ochie is an employee of Flywheel Outfitters, Inc. Gross earnings for federal income tax withholding, Social Security tax, and Medicare tax were $163,501.80 for the year, while these taxes were $15,270, $8,853.60, and $2,370.78 respectively. Annual union dues were $625, while Albert elects to have charitable contributions of $300 withheld. South Carolina income tax withholding was $7,944.03 (based on the above gross earnings for federal income tax), with no local taxes withheld Notes: . For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. Open Directions in Popup Window b 33333 Kind of Payer (Check one) a Control number c Total number of Forms W-2 99-9999999 941 CT-1 e Employer identification number (EIN) Military Hshld. emp. 943 f Employer's name Flywheel Outfitters, Inc. Medicare govt emp. d Establishment number DO NOT STAPLE For Official Use Only OMB No. 1545-0008 944 Kind of Employer (Check one) None apply 9 State/local non-501c 1 Wages, tips, other compensation $82,476.05 3 Social security wages $ 5 Medicare wages and tips $ 7 Social security tips $ 501c non-govt. State/local 501c Federal govt. 2 Federal income tax withheld $8,645.00 4 Social security tax withheld $5,113.52 6 Medicare tax withheld $1,195.90 8 Allocated tips $ 10 Dependent care benefits Third-party sick pay (Check if applicable)

tane nithold Notes: en Drectoons in Pooup Window unser penines spuien Albent Odice President Date 1/31/2022 V-3 Transmittal of Wage and Tax Statements DXX