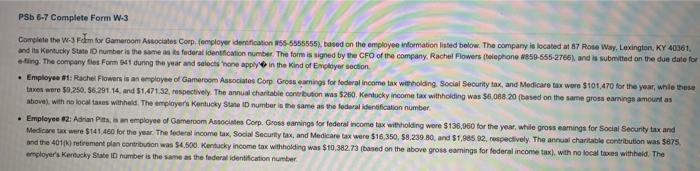

Question: W-2 PSb 6-7 Complete Form W-3 Complete the W-3 Form for Gameroom Associates Corp employer identification 55-5555555), based on the employee formation listed below. The

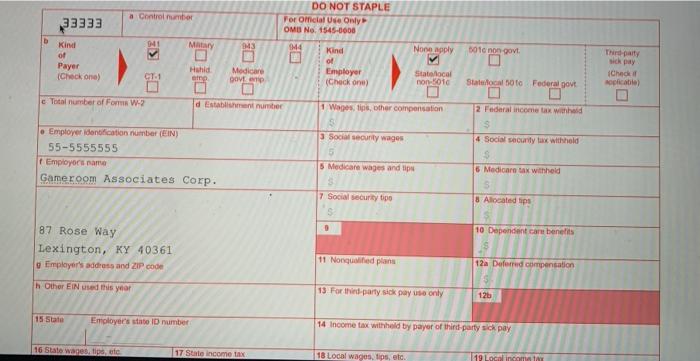

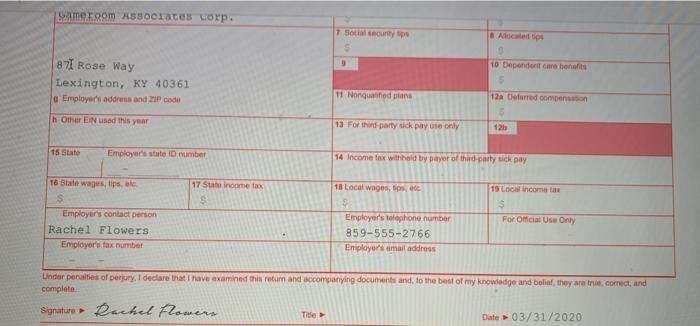

PSb 6-7 Complete Form W-3 Complete the W-3 Form for Gameroom Associates Corp employer identification 55-5555555), based on the employee formation listed below. The company is located at 87 Rose Way, Lexington, KY 40361 and the Kentucky State ID number is the same as ts federal identification number. The form is signed by the CFO of the company, Rachel Flowers (lephone 050-555-2706) and is submitted on the due date for afing. The companyies Form 941 during the year and select one apply in the kind of Employer section . Employee : Rachel Flowers in an employee of Gameroon Associates Corp Gross earnings for federal income tax will holding Social Security tax, and Medicare tax were $101,470 for the year, while these tnxes were 50.250, 56,291 14. and 51.47132, respectively. The annual charitable contrbuon was $280, Kentucky income tax withholding was $6,088 20 (based on the same gross earnings amount as above with no local taxes withheld. The employer's Kentucky State ID number is the same as the federal dentification number . Employee 2: Adrian Pts, an employee of Gamercom Asociates Corp. Gross caring for federal income tax withholding were $136,960 for the year, while gross earnings for Social Securty tax and Medicare tax were $141.460 for the year. The federal income tax, Social Security tax, and Medicare tax were $16,350, 58,239.00 and $1,985 92, respectively. The annual charitable contribution was 5875 and the 401k retirement plan contribution was $4.500. Kentucky income tax withholding was $10,382.73 (based on the above gross comings for federal income tax), with no local taxes withheld. The employer's Kentucky State ID number is the same as the federal identification number a Control number 33333 DO NOT STAPLE For Omcial Use Only OM No. 1545-0008 b 141 Mary M3 M4 None Apply 5010 non govt Kini of Payer (Checko) Hshid Medicare govt Kind of Employer Check on That sich pay Check picable) Stato local non 5016 Statelocal soto Federal govt Total number of Form - d Establishment number 1 Wages, lins, other compensation 2 Federal income tax withheld 4 Social security tax withhold Employer identification number (EIN) 55-5555555 Employers name Gameroom Associates Corp. Social Security wages 5 5 Medicare wages and lip 6 Medicare tax withhold 7 Social Security tipo 8 Alocated lips 0 10 Dependent care benefits 8 RI Way Lexington, KY 40361 Employer's address and ZIP code 11 Noned plans 12a Deferred compensation Other EIN used this year 13 For third party sick pay use only 12b 15 State Employer's state ID number 14 Income tax withold by payer of third-party sick pay 16 State wages, tips, efe 17 State income tax 18 Local wages, tips, etc 19 Local income Samenom ASSOCIAtes corp. tt Bes 10 Dependent care benefits 871 Rose Way Dexington, KY 40361 Employer's address and ZIP code 11 Nonquedos 12 fed compon h Other EIN used this year 13 For third-party sick pay use only 12 15 State Employer's state ID number 14 Income tax withheld by ayer of third-party sick pay 17 Sabinome tax 18 Local wages, tips, 19 Local incomat 16 Bate wages, tips, ale S Employer's contact person Rachel Flowers Employer's fax number For Omiciat Use Only Employer's Talehone number 859-555-2766 Employer's email address Under penalties of perjury, I declare that I have examined this return and accompanying documents and to the best of my knowledge and belief, they are the correct, and complete Signature Rachel Powers Title Date 03/31/2020 PSb 6-7 Complete Form W-3 Complete the W-3 Form for Gameroom Associates Corp employer identification 55-5555555), based on the employee formation listed below. The company is located at 87 Rose Way, Lexington, KY 40361 and the Kentucky State ID number is the same as ts federal identification number. The form is signed by the CFO of the company, Rachel Flowers (lephone 050-555-2706) and is submitted on the due date for afing. The companyies Form 941 during the year and select one apply in the kind of Employer section . Employee : Rachel Flowers in an employee of Gameroon Associates Corp Gross earnings for federal income tax will holding Social Security tax, and Medicare tax were $101,470 for the year, while these tnxes were 50.250, 56,291 14. and 51.47132, respectively. The annual charitable contrbuon was $280, Kentucky income tax withholding was $6,088 20 (based on the same gross earnings amount as above with no local taxes withheld. The employer's Kentucky State ID number is the same as the federal dentification number . Employee 2: Adrian Pts, an employee of Gamercom Asociates Corp. Gross caring for federal income tax withholding were $136,960 for the year, while gross earnings for Social Securty tax and Medicare tax were $141.460 for the year. The federal income tax, Social Security tax, and Medicare tax were $16,350, 58,239.00 and $1,985 92, respectively. The annual charitable contribution was 5875 and the 401k retirement plan contribution was $4.500. Kentucky income tax withholding was $10,382.73 (based on the above gross comings for federal income tax), with no local taxes withheld. The employer's Kentucky State ID number is the same as the federal identification number a Control number 33333 DO NOT STAPLE For Omcial Use Only OM No. 1545-0008 b 141 Mary M3 M4 None Apply 5010 non govt Kini of Payer (Checko) Hshid Medicare govt Kind of Employer Check on That sich pay Check picable) Stato local non 5016 Statelocal soto Federal govt Total number of Form - d Establishment number 1 Wages, lins, other compensation 2 Federal income tax withheld 4 Social security tax withhold Employer identification number (EIN) 55-5555555 Employers name Gameroom Associates Corp. Social Security wages 5 5 Medicare wages and lip 6 Medicare tax withhold 7 Social Security tipo 8 Alocated lips 0 10 Dependent care benefits 8 RI Way Lexington, KY 40361 Employer's address and ZIP code 11 Noned plans 12a Deferred compensation Other EIN used this year 13 For third party sick pay use only 12b 15 State Employer's state ID number 14 Income tax withold by payer of third-party sick pay 16 State wages, tips, efe 17 State income tax 18 Local wages, tips, etc 19 Local income Samenom ASSOCIAtes corp. tt Bes 10 Dependent care benefits 871 Rose Way Dexington, KY 40361 Employer's address and ZIP code 11 Nonquedos 12 fed compon h Other EIN used this year 13 For third-party sick pay use only 12 15 State Employer's state ID number 14 Income tax withheld by ayer of third-party sick pay 17 Sabinome tax 18 Local wages, tips, 19 Local incomat 16 Bate wages, tips, ale S Employer's contact person Rachel Flowers Employer's fax number For Omiciat Use Only Employer's Talehone number 859-555-2766 Employer's email address Under penalties of perjury, I declare that I have examined this return and accompanying documents and to the best of my knowledge and belief, they are the correct, and complete Signature Rachel Powers Title Date 03/31/2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts