Question: python 2. For a single person the 2020 IRS tax brackets give a tax rate of 10% on the first $9,875 of taxable income e

python

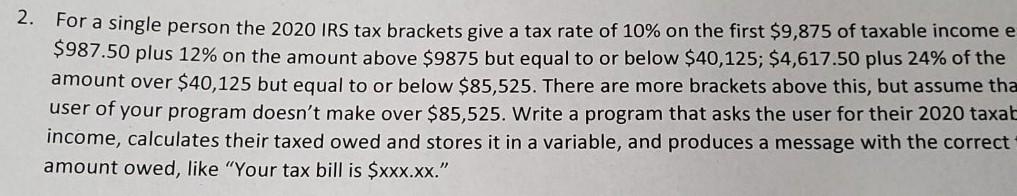

2. For a single person the 2020 IRS tax brackets give a tax rate of 10% on the first $9,875 of taxable income e $987.50 plus 12% on the amount above $9875 but equal to or below $40,125; $4,617.50 plus 24% of the amount over $40,125 but equal to or below $85,525. There are more brackets above this, but assume tha user of your program doesn't make over $85,525. Write a program that asks the user for their 2020 taxab income, calculates their taxed owed and stores it in a variable, and produces a message with the correct amount owed, like "Your tax bill is $xxx.xx

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts