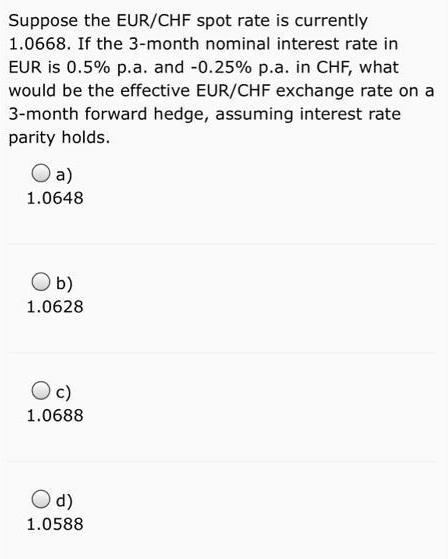

Question: Suppose the EUR/CHF spot rate is currently 1.0668. If the 3-month nominal interest rate in EUR is 0.5% p.a. and -0.25% p.a. in CHF,

Suppose the EUR/CHF spot rate is currently 1.0668. If the 3-month nominal interest rate in EUR is 0.5% p.a. and -0.25% p.a. in CHF, what would be the effective EUR/CHF exchange rate on a 3-month forward hedge, assuming interest rate parity holds. a) 1.0648 O b) 1.0628 O c) 1.0688 d) 1.0588

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Sol Spait Rate 5 EURCHF 3 mmth Forward rate F CHF Home currency d 2 EUR Forei... View full answer

Get step-by-step solutions from verified subject matter experts