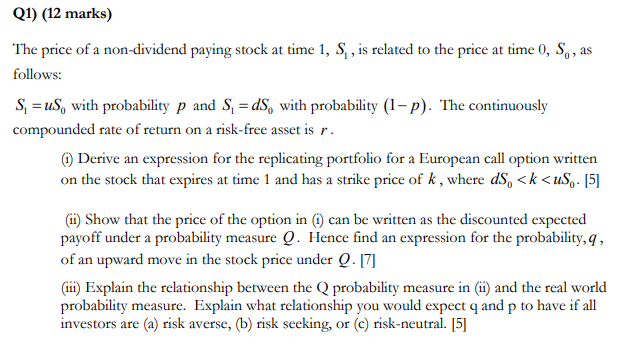

Question: Q 1 ) ( 1 2 marks ) The price of a non - dividend paying stock at time 1 , S 1 , is

Q marks

The price of a nondividend paying stock at time is related to the price at time as

follows:

with probability and with probability The continuously

compounded rate of return on a riskfree asset is

i Derive an expression for the replicating portfolio for a European call option written

on the stock that expires at time and has a strike price of where

Show that the price the option can written the discounted expected

payoff under a probability measure Hence find expression for the probability,

upward move the stock price under

Explain the relationship between the probability measure and the real world

probability measure. Explain what relationship you would expect and have all

investors are risk averse, risk seeking, riskneutral.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock