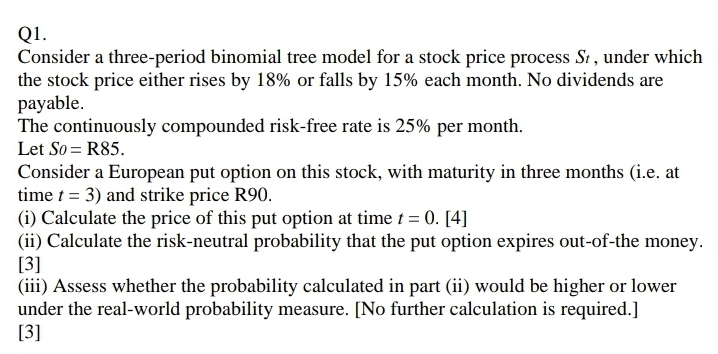

Question: Q 1 . Consider a three - period binomial tree model for a stock price process S t , under which the stock price either

Q

Consider a threeperiod binomial tree model for a stock price process under which the stock price either rises by or falls by each month. No dividends are payable.

The continuously compounded riskfree rate is per month.

Let R

Consider a European put option on this stock, with maturity in three months ie at time and strike price R

i Calculate the price of this put option at time

ii Calculate the riskneutral probability that the put option expires outofthe money.

iii Assess whether the probability calculated in part ii would be higher or lower under the realworld probability measure. No further calculation is required.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock