Question: Q . 6 ( 1 0 points ) Consider a three date environment, t = 0 , 1 , 2 , t = 0 is

Q points

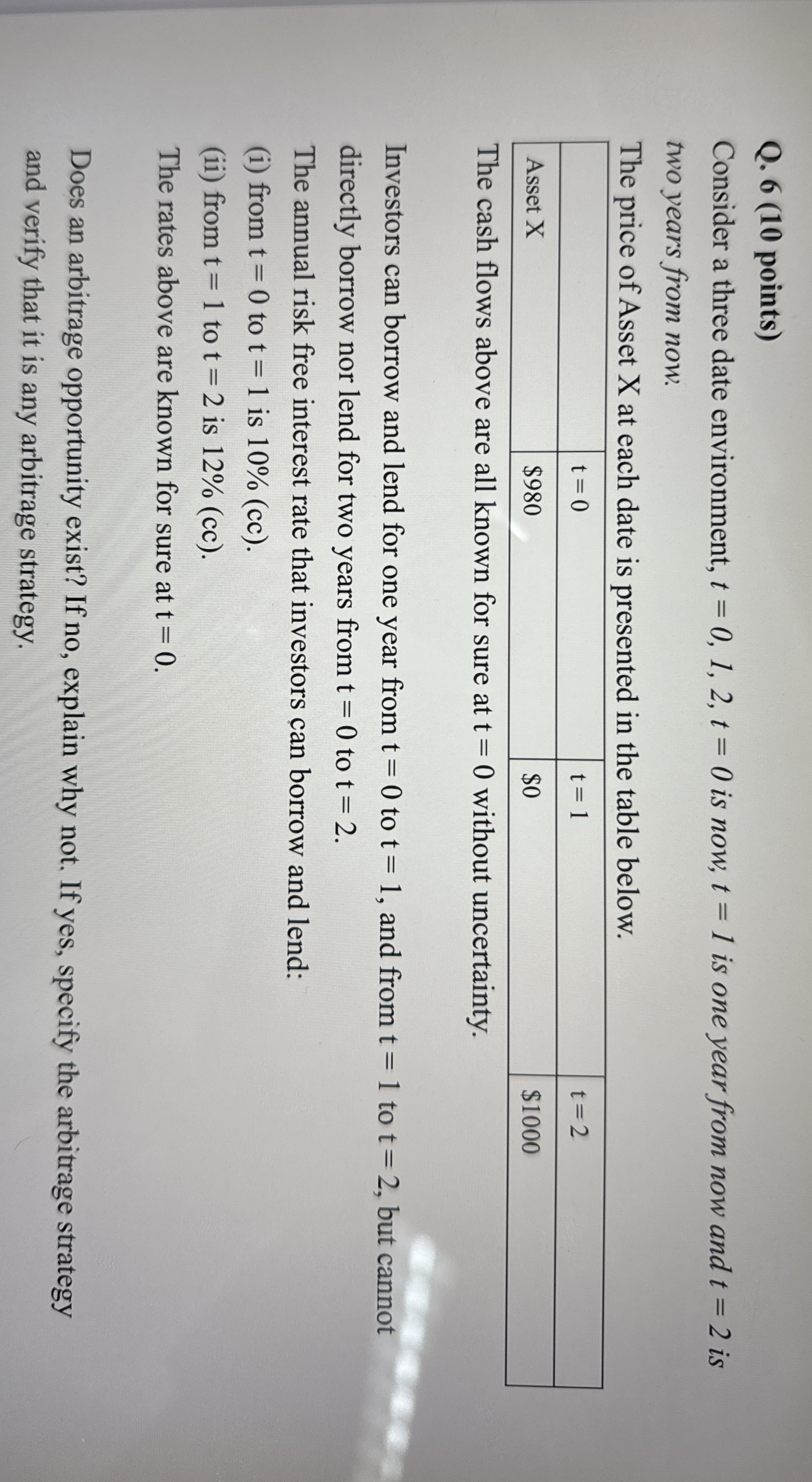

Consider a three date environment, is now, is one year from now and is

two years from now.

The price of Asset X at each date is presented in the table below.

The cash flows above are all known for sure at without uncertainty.

Investors can borrow and lend for one year from to and from to but cannot

directly borrow nor lend for two years from to

The annual risk free interest rate that investors can borrow and lend:

i from to is cc

ii from to is cc

The rates above are known for sure at

Does an arbitrage opportunity exist? If no explain why not. If yes, specify the arbitrage strategy

and verify that it is any arbitrage strategy.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock