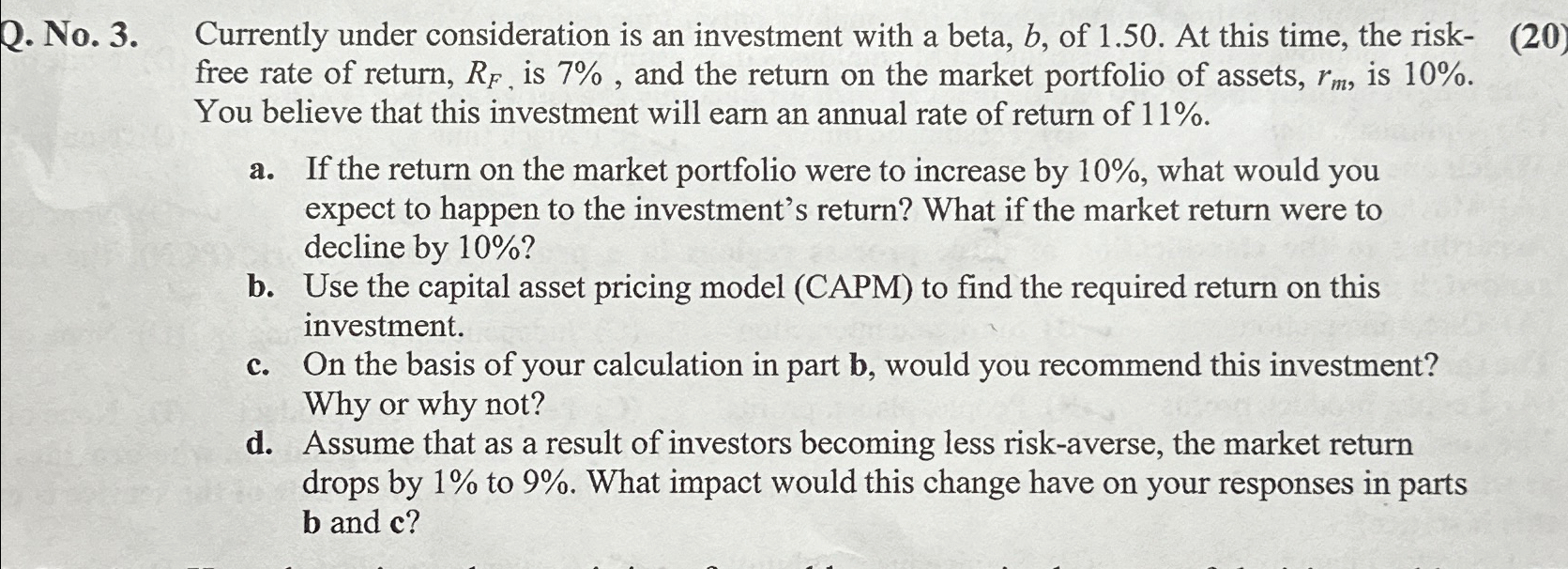

Question: Q . No . 3 . Currently under consideration is an investment with a beta, b , of 1 . 5 0 . At this

Q No Currently under consideration is an investment with a beta, of At this time, the riskfree rate of return, is and the return on the market portfolio of assets, is You believe that this investment will earn an annual rate of return of

a If the return on the market portfolio were to increase by what would you expect to happen to the investment's return? What if the market return were to decline by

b Use the capital asset pricing model CAPM to find the required return on this investment.

c On the basis of your calculation in part b would you recommend this investment? Why or why not?

d Assume that as a result of investors becoming less riskaverse, the market return drops by to What impact would this change have on your responses in parts and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock