Question: Q1. Ch. 5 last pic shows drop down menu Q 2 Ch. 5 Last poc shows the drop dowm menu and question 2 is 3

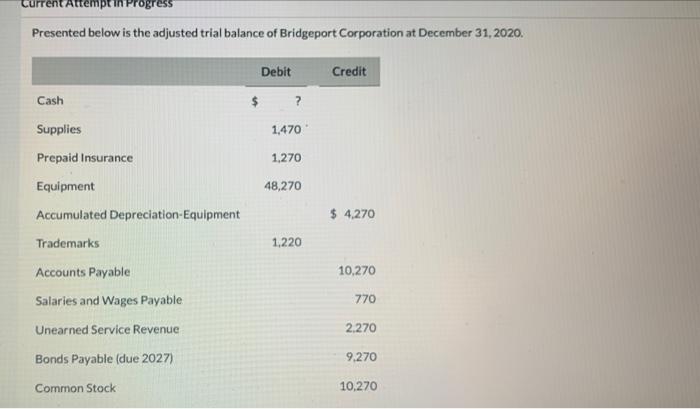

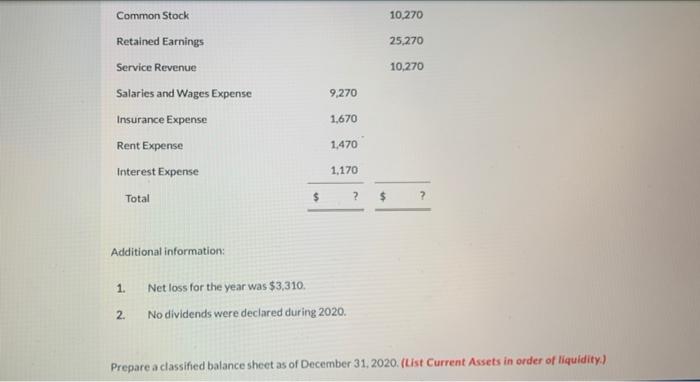

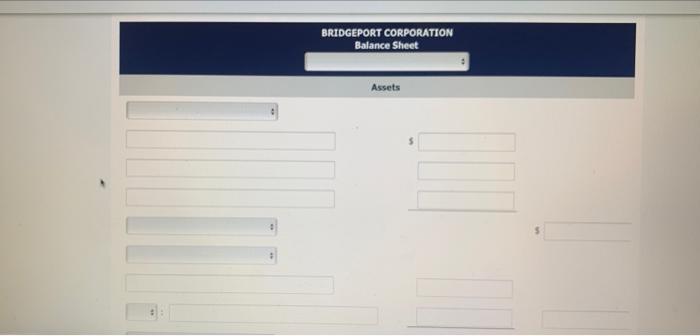

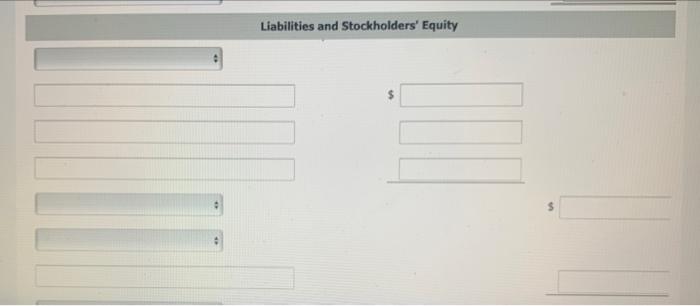

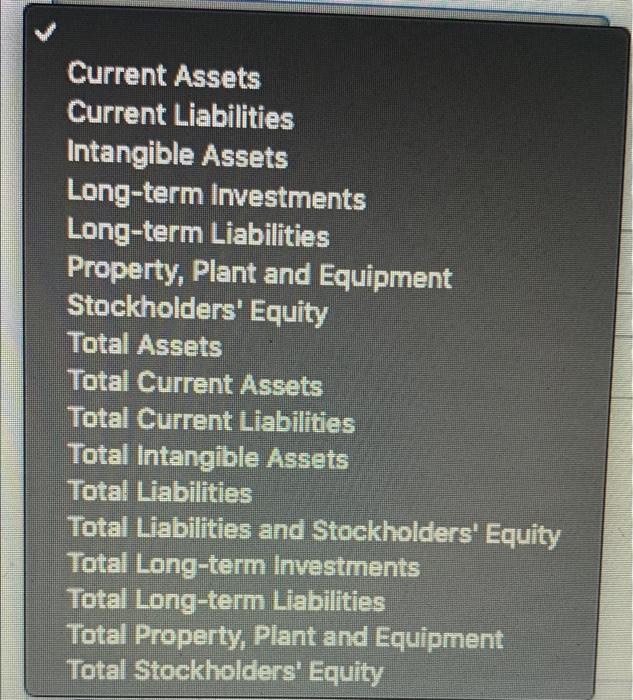

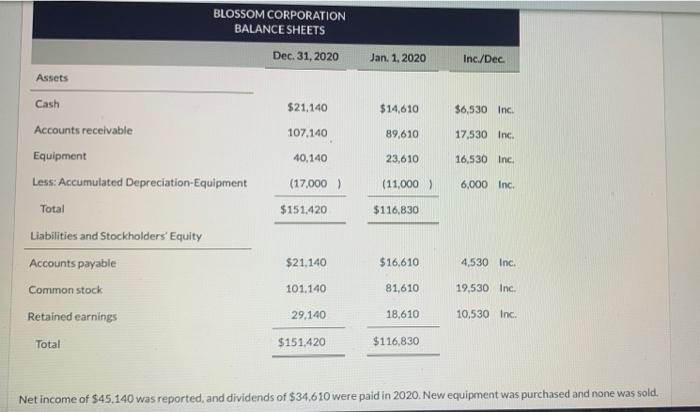

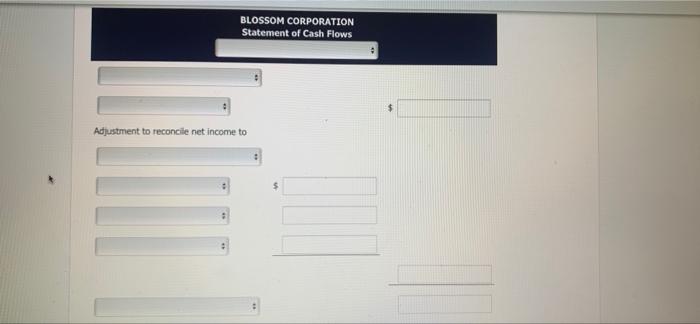

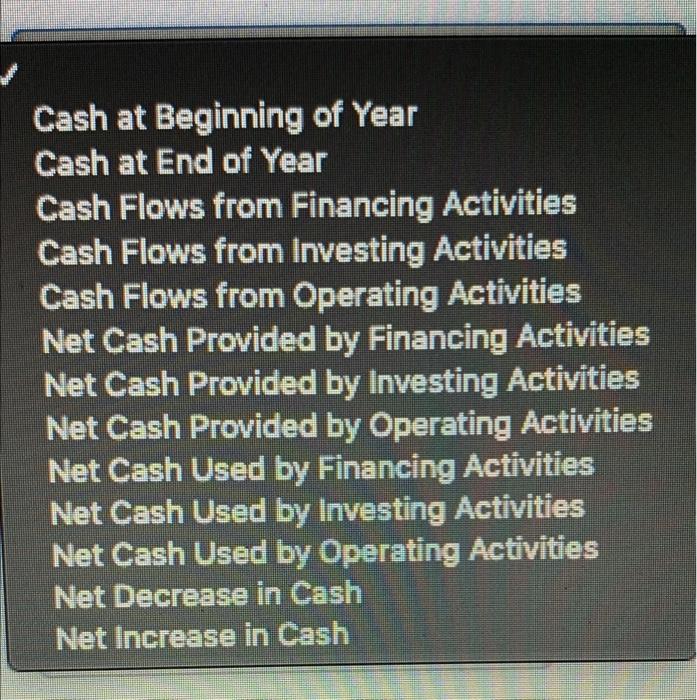

urrent Attempt in Progress Presented below is the adjusted trial balance of Bridgeport Corporation at December 31, 2020. Cash Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment Trademarks Accounts Payable Salaries and Wages Payable Unearned Service Revenue Bonds Payable (due 2027) Common Stock $ Debit 1,470 1,270 48,270 1,220 Credit $ 4,270 10,270 770 2,270 9,270 10,270 Common Stock Retained Earnings Service Revenue Salaries and Wages Expense Insurance Expense Rent Expense Interest Expense Total Additional information: 1. 2. $ 9,270 1,670 1,470 1,170 Net loss for the year was $3,310. No dividends were declared during 2020. ? $ 10,270 25,270 10,270 ? Prepare a classified balance sheet as of December 31, 2020. (List Current Assets in order of liquidity.) BRIDGEPORT CORPORATION Balance Sheet Assets 1 Liabilities and Stockholders' Equity Question 1 of 2 Current Assets Current Liabilities Intangible Assets Long-term Investments Long-term Liabilities Property, Plant and Equipment Stockholders' Equity Total Assets Total Current Assets Total Current Liabilities Total Intangible Assets Total Liabilities Total Liabilities and Stockholders' Equity Total Long-term Investments Total Long-term Liabilities Total Property, Plant and Equipment Total Stockholders' Equity Assets BLOSSOM CORPORATION BALANCE SHEETS Dec. 31, 2020 Cash Accounts receivable Equipment Less: Accumulated Depreciation-Equipment Total Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total $21,140 107,140 40,140 (17,000) $151,420 $21.140 101.140 29,140 $151,420 Jan, 1, 2020 $14,610 89,610 23,610 (11,000) $116,830 $16,610 81,610 18,610 $116,830 Inc./Dec. $6,530 Inc. 17,530 Inc. 16,530 Inc. 6,000 Inc. 4,530 Inc.. 19,530 Inc. 10,530 Inc. Net income of $45.140 was reported, and dividends of $34,610 were paid in 2020. New equipment was purchased and none was sold. BLOSSOM CORPORATION Statement of Cash Flows Adjustment to reconcile net income to # Question 2 of 2 -/1 = 1 Cash at Beginning of Year Cash at End of Year Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used by Financing Activities Net Cash Used by Investing Activities Net Cash Used by Operating Activities Net Decrease in Cash Net Increase in Cash (b) The parts of this question must be completed in order. This part will be available when you complete the part above. (c) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts