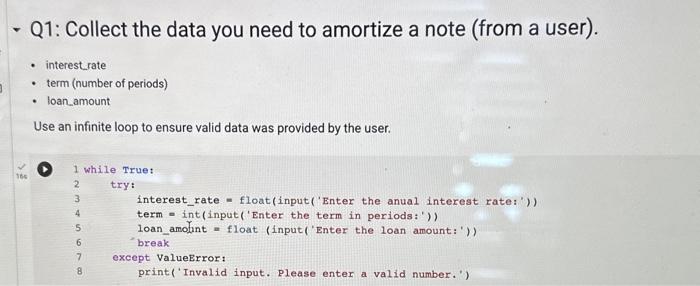

Question: Q1: Collect the data you need to amortize a note (from a user). - interest rate - term (number of periods) - loan_amount Use an

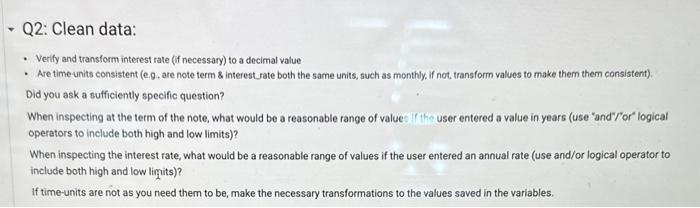

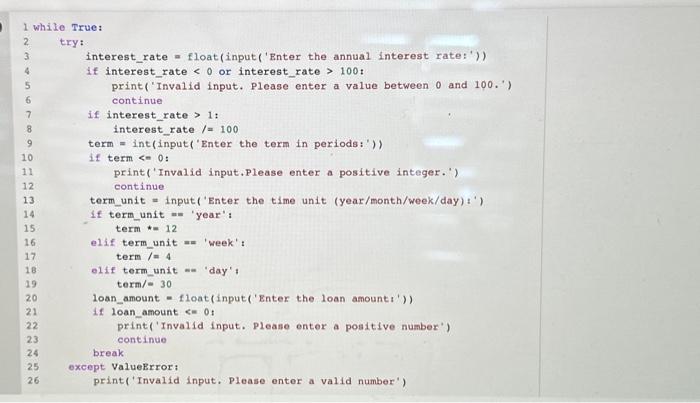

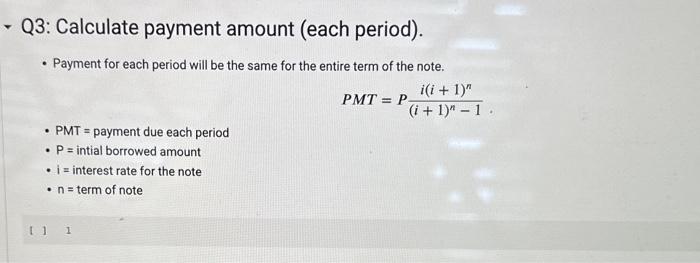

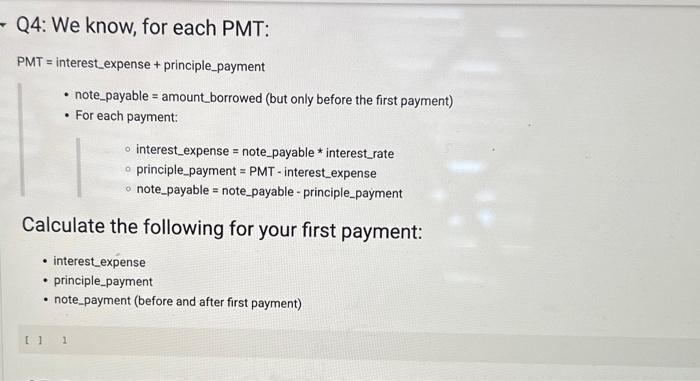

Q1: Collect the data you need to amortize a note (from a user). - interest rate - term (number of periods) - loan_amount Use an infinite loop to ensure valid data was provided by the user. Q2: Clean data: - Verify and transform interest rate (if necessary) to a decimal value - Are time units consistent (eg, are note term \& interest rate both the same units, such as monthly, if not, transform values to make them them consistent). Did you ask a sufficiently specific question? When inspecting at the term of the note, what would be a reasonable range of value: the user entered a value in years (use "and"/"or" logical operators to include both high and low limits)? When inspecting the interest rate, what would be a reasonable range of values if the user entered an annual rate (use and/or logical operator to include both high and low limits)? If time-units are not as you need them to be, make the necessary transformations to the values saved in the variables. Q3: Calculate payment amount (each period). - Payment for each period will be the same for the entire term of the note. PMT=P(i+1)n1i(i+1)n - PMT = payment due each period - P= intial borrowed amount - i = interest rate for the note Q4: We know, for each PMT: PMT = interest_expense + principle_payment - note_payable = amount_borrowed (but only before the first payment) - For each payment: - interest_expense = note_payable * interest_rate - principle_payment = PMT - interest_expense - note_payable = note_payable principle_payment Calculate the following for your first payment: - interest_expense - principle_payment - note_payment (before and after first payment)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts