Question: Q1: FIFO Method, why did they use this formula (900+(1820/140)*130), and where did they get 900 and 130 from? Q2: LIFO Method, why did they

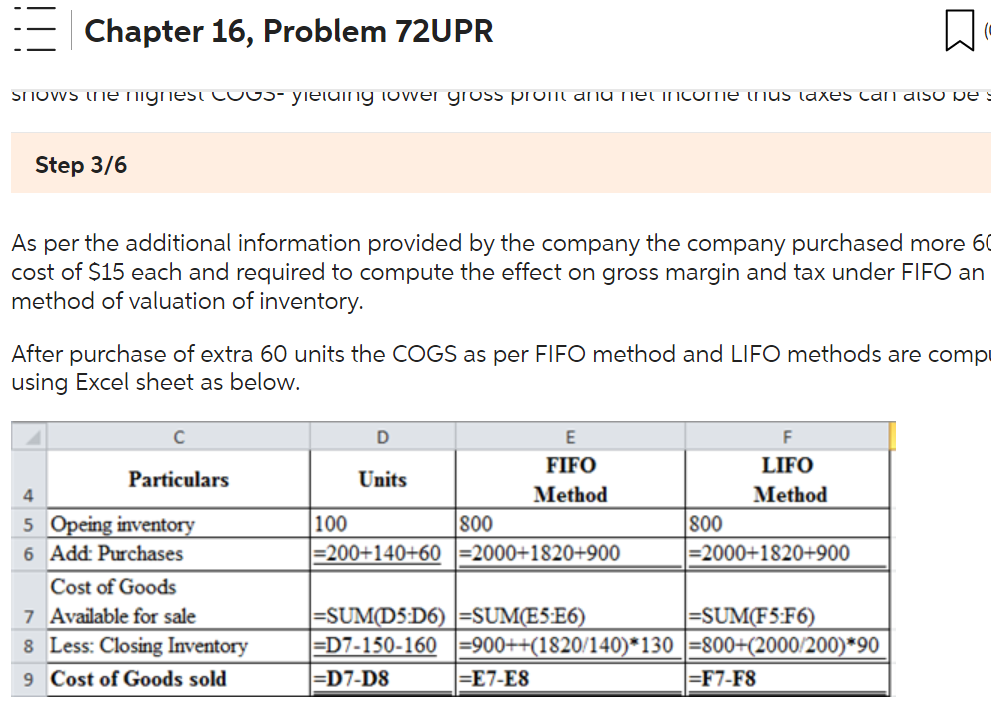

Q1: FIFO Method, why did they use this formula (900+(1820/140)*130), and where did they get 900 and 130 from?

Q2: LIFO Method, why did they use this formula (800+(2000/200)*90), and where did they get 800 and 90 from?

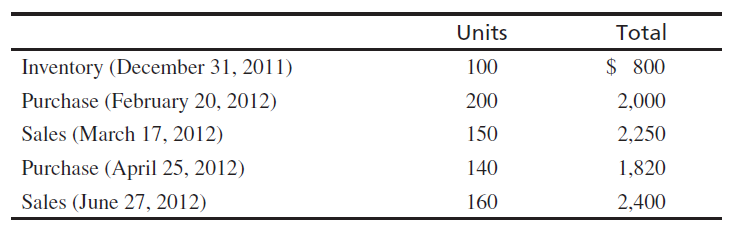

\begin{tabular}{lcc} \hline & Units & Total \\ \hline Inventory (December 31, 2011) & 100 & $800 \\ Purchase (February 20, 2012) & 200 & 2,000 \\ Sales (March 17, 2012) & 150 & 2,250 \\ Purchase (April 25, 2012) & 140 & 1,820 \\ Sales (June 27, 2012) & 160 & 2,400 \\ \hline \end{tabular} As per the additional information provided by the company the company purchased more 6 cost of $15 each and required to compute the effect on gross margin and tax under FIFO an method of valuation of inventory. After purchase of extra 60 units the COGS as per FIFO method and LIFO methods are comp using Excel sheet as below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts