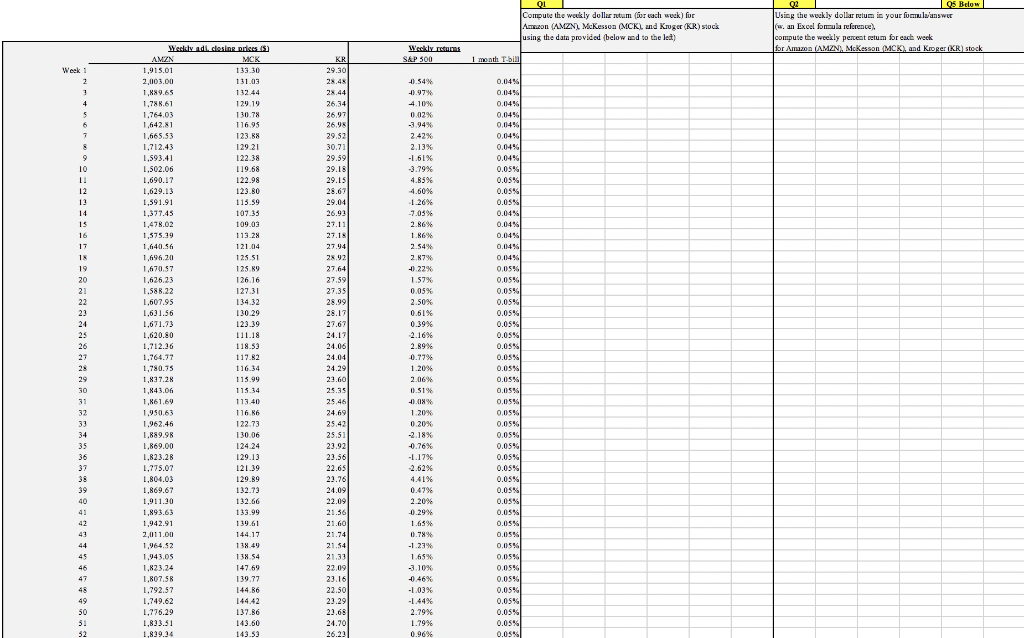

Question: Q11 Compute the workly dollar num (for each week) for Azezon (AMZN), McKesson (MCKL and Kruger (KR) stock using the data provided (below eed to

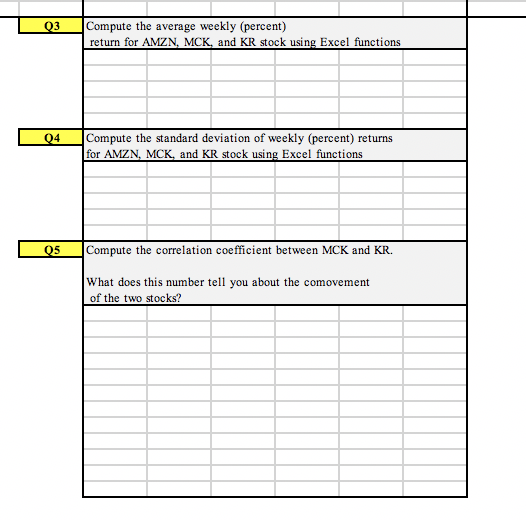

Q11 Compute the workly dollar num (for each week) for Azezon (AMZN), McKesson (MCKL and Kruger (KR) stock using the data provided (below eed to the led) 05 Below Using the weekly dollar rulum in your fummula/answer (w. an Excel formula reference) compute the weekly percent retum for each week for Amazon (AMZN). McKesson (MCK). and Kroger (KR) stock Weekly returns S&P 500 1 month T-bill KR 29.30 Week 1 3 4 7 0.04% 0.04% 0.04% 0,04% 0.04% 0.04% 0.04% 0.04% 0.05% 0.05% 0.05% 0.05% % 0.04% 9 10 11 1. 14 15 16 17 18 19 20 21 22 23 24 25 . 26 Wellyadi. dosing press (5) AMN MCK 1.915.01 133.30 2,000.00 131.03 1.889.69 132.44 1,788.61 129.19 1.764,03 130.78 1.642.81 116.95 1.665.53 123.8 1,712.43 129 21 1.593.41 122.38 1.502.06 119.58 1,690.17 122.98 1,629.13 123.80 1.591.91 115.59 1,377.45 107.33 1,478.02 109.03 1,575.19 113.28 1.640.56 121.04 1,696.20 125.51 1.670.57 125.89 1.626.23 126.16 1.588.22 127.31 1,607.95 134.32 1.631.56 130.29 1.671.73 123.39 1.620.80 111.18 1,712.96 118.53 1,764,77 117.82 1.780.75 116.34 1,837.28 115.99 1.843.06 115.34 1.861.69 113.40 1.950.63 116.86 1,962.46 122.73 1.889.98 130.06 1.869.00 124.24 129.13 1.775.07 121.39 1.804.03 129 89 1.869.67 132.73 1,911.30 132.66 1,893.63 133.99 1,942.91 139.61 2,011.00 144.17 1,964.52 138.49 1,943.05 138.54 1.823.24 147.69 1.807.58 139.77 1.792.57 144.86 1.749.62 144.42 1.776.29 137.86 1,893.51 143.50 1,839.34 143.53 28.44 26,34 26.97 26.98 29.52 30.71 29.59 29.18 29.15 28.67 29.041 26.93 27.11 27.18 27.94 2x 92 27.64 27.59 27.35 28.99 28.12 27.67 24.17 24.06 24.04 24.29 23.60 25.35 25.46 24.69 25.42 25.51 23.92 23.56 22.65 29.76 24.09 22.09 21.36 21.60 -0.54% 40.97% 4.10 0.02% -3.94% 2.42% 2.13% -1.61% -3.79% % 4.85% 4.60% 1.26% -7.03% 2.86% 1.86% 2.54% 2.67% 1.22% 1.57% 0.05% 2.50% 0.61% 0.39% 2.16% 2.89% 0.77% 1.20% 2.06% 0.519 0.08 1.20% 0.20% 2.18% -0.76% -1.17% 2.62% 4.41% 0.47% 2.20% -0.29% 1.63% 0.78% -1.23% 1.65% -3.10% -0.46% -1.03% 27 25 29 30 31 32 33 34 35 36 37 0.04% 0.04% % 0.04% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% % 0.05% 0.05% 0.05% 0.05% 0.0596 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0,05% 0.05% % 0.05% 0.05% % 0.05% 0.05% 0.05% 0.05% 1,823.28 39 40 41 42 41 44 45 46 47 45 49 50 21.54 21.33 22.09 23.16 22.50 23.29 23.68 24.70 26.23 2.79% 1.79% 0.96% 52 03 Compute the average weekly (percent) return for AMZN, MCK, and KR stock using Excel functions Q4 Compute the standard deviation of weekly (percent) returns for AMZN, MCK, and KR stock using Excel functions 05 Compute the correlation coefficient between MCK and KR. What does this number tell you about the comovement of the two stocks? Q11 Compute the workly dollar num (for each week) for Azezon (AMZN), McKesson (MCKL and Kruger (KR) stock using the data provided (below eed to the led) 05 Below Using the weekly dollar rulum in your fummula/answer (w. an Excel formula reference) compute the weekly percent retum for each week for Amazon (AMZN). McKesson (MCK). and Kroger (KR) stock Weekly returns S&P 500 1 month T-bill KR 29.30 Week 1 3 4 7 0.04% 0.04% 0.04% 0,04% 0.04% 0.04% 0.04% 0.04% 0.05% 0.05% 0.05% 0.05% % 0.04% 9 10 11 1. 14 15 16 17 18 19 20 21 22 23 24 25 . 26 Wellyadi. dosing press (5) AMN MCK 1.915.01 133.30 2,000.00 131.03 1.889.69 132.44 1,788.61 129.19 1.764,03 130.78 1.642.81 116.95 1.665.53 123.8 1,712.43 129 21 1.593.41 122.38 1.502.06 119.58 1,690.17 122.98 1,629.13 123.80 1.591.91 115.59 1,377.45 107.33 1,478.02 109.03 1,575.19 113.28 1.640.56 121.04 1,696.20 125.51 1.670.57 125.89 1.626.23 126.16 1.588.22 127.31 1,607.95 134.32 1.631.56 130.29 1.671.73 123.39 1.620.80 111.18 1,712.96 118.53 1,764,77 117.82 1.780.75 116.34 1,837.28 115.99 1.843.06 115.34 1.861.69 113.40 1.950.63 116.86 1,962.46 122.73 1.889.98 130.06 1.869.00 124.24 129.13 1.775.07 121.39 1.804.03 129 89 1.869.67 132.73 1,911.30 132.66 1,893.63 133.99 1,942.91 139.61 2,011.00 144.17 1,964.52 138.49 1,943.05 138.54 1.823.24 147.69 1.807.58 139.77 1.792.57 144.86 1.749.62 144.42 1.776.29 137.86 1,893.51 143.50 1,839.34 143.53 28.44 26,34 26.97 26.98 29.52 30.71 29.59 29.18 29.15 28.67 29.041 26.93 27.11 27.18 27.94 2x 92 27.64 27.59 27.35 28.99 28.12 27.67 24.17 24.06 24.04 24.29 23.60 25.35 25.46 24.69 25.42 25.51 23.92 23.56 22.65 29.76 24.09 22.09 21.36 21.60 -0.54% 40.97% 4.10 0.02% -3.94% 2.42% 2.13% -1.61% -3.79% % 4.85% 4.60% 1.26% -7.03% 2.86% 1.86% 2.54% 2.67% 1.22% 1.57% 0.05% 2.50% 0.61% 0.39% 2.16% 2.89% 0.77% 1.20% 2.06% 0.519 0.08 1.20% 0.20% 2.18% -0.76% -1.17% 2.62% 4.41% 0.47% 2.20% -0.29% 1.63% 0.78% -1.23% 1.65% -3.10% -0.46% -1.03% 27 25 29 30 31 32 33 34 35 36 37 0.04% 0.04% % 0.04% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% % 0.05% 0.05% 0.05% 0.05% 0.0596 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0,05% 0.05% % 0.05% 0.05% % 0.05% 0.05% 0.05% 0.05% 1,823.28 39 40 41 42 41 44 45 46 47 45 49 50 21.54 21.33 22.09 23.16 22.50 23.29 23.68 24.70 26.23 2.79% 1.79% 0.96% 52 03 Compute the average weekly (percent) return for AMZN, MCK, and KR stock using Excel functions Q4 Compute the standard deviation of weekly (percent) returns for AMZN, MCK, and KR stock using Excel functions 05 Compute the correlation coefficient between MCK and KR. What does this number tell you about the comovement of the two stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts