Question: Q2. 15 marks. A project has been planned for cleaning work of a lake that has been polluted due to several industrial discharges and other

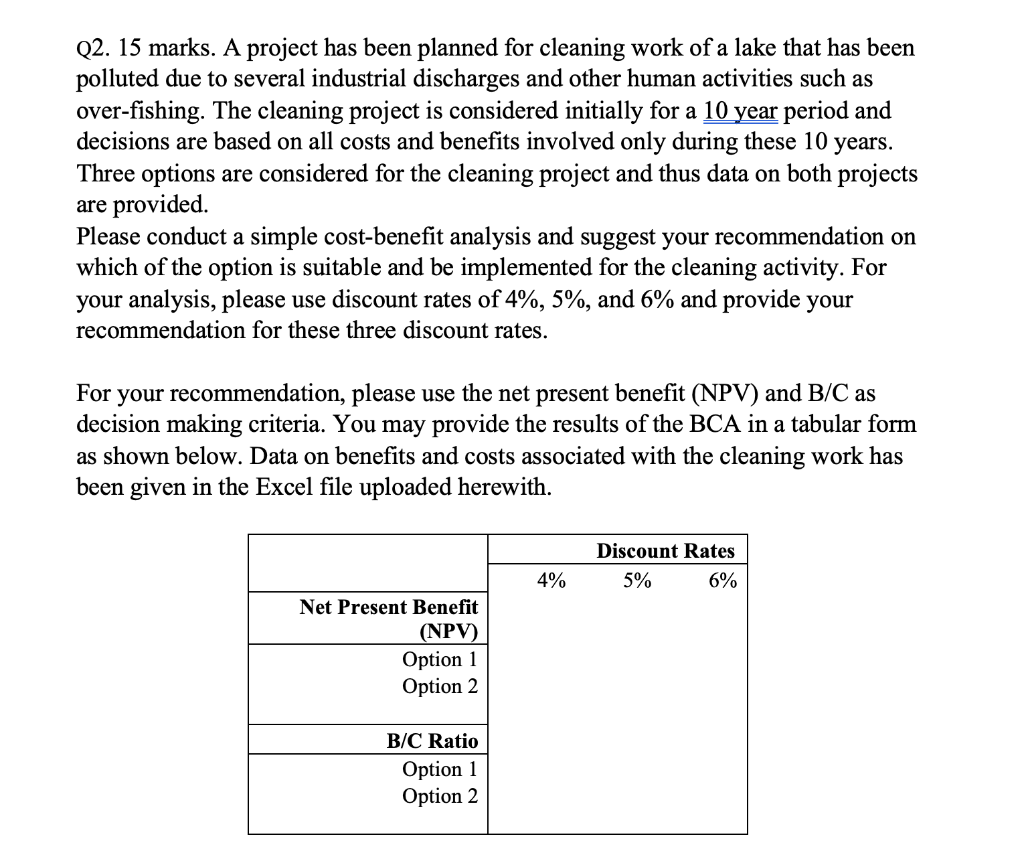

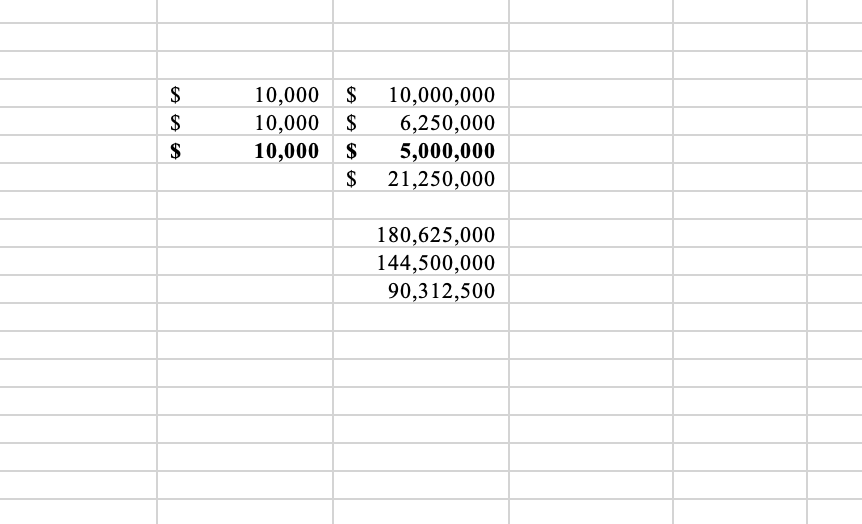

Q2. 15 marks. A project has been planned for cleaning work of a lake that has been polluted due to several industrial discharges and other human activities such as over-fishing. The cleaning project is considered initially for a 10 year period and decisions are based on all costs and benefits involved only during these 10 years. Three options are considered for the cleaning project and thus data on both projects are provided. Please conduct a simple cost-benefit analysis and suggest your recommendation on which of the option is suitable and be implemented for the cleaning activity. For your analysis, please use discount rates of 4%, 5%, and 6% and provide your recommendation for these three discount rates. For your recommendation, please use the net present benefit (NPV) and B/C as decision making criteria. You may provide the results of the BCA in a tabular form as shown below. Data on benefits and costs associated with the cleaning work has been given in the Excel file uploaded herewith. Discount Rates 5% 6% 4% Net Present Benefit (NPV) Option 1 Option 2 B/C Ratio Option 1 Option 2 $$ $ 10,000 10,000 10,000 $ $ $ $ 10,000,000 6,250,000 5,000,000 21,250,000 180,625,000 144,500,000 90,312,500 Interest Rate 0.04 0 6 7 8 9 10 Year Option 1 Capital Cost Operating Cost Benefit Total NPV 180,625,000 0 0 180,625,000 100,000 10.000.000 9.900.000 100,000 100,000 100,000 15,000,000 20,000,000 30.000.000 14,900,000 19,900,000 29.900.000 100,000 100,000 100,000 30,000,000 30,000,000 30,000,000 30,000,000 29.900.000 29.900,000 100,000 100,000 30,000,000 ######## 29.900.000 100,000 30,000,000 29.900.000 Present Value of Costs Presnt Value of Benefits B/C Ratio B 144,500,000 2.000.000 Project 2 Capital Cost Operating Cost Benefit Total NPV 2,000,000 5.000.000 3,000,000 2,000,000 10.000.000 8,000,000 2,000,000 2,000,000 20,000,000 25.000.000 18,000,000 23,000,000 2,000,000 2,000,000 2,000,000 25.000.000 30,000,000 30.000.000 23,000,000 28,000,000 28,000,000 28.000.000 2,000,000 ####### 2,000,000 30.000.000 28,000,000 144,500,000 ######## Present Value of Costs Presnt Value of Bencfits B/C Ratio 90,312,500 Project 3 Capital Cost Operating Cost Bcncfit Total NPV 5,600,000 5.000.000 600,000 5,600,000 10,000,000 4,400,000 5.600.000 5.600,000 10,000,000 20,000,000 4,400,000 14,400,000 5,600,000 5,600,000 5,600,000 5,600,000 25.000.000 25,000,000 25.000.000 ######### 19,400,000 19,400,000 19,400,000 5,600,000 5,600,000 ######### 30,000,000 ######### 24,400,000 90,312,500 Present Valuc of Costs Presnt Value of Benefits B/C Ratio B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts