Question: Q2. Using historical data to measure portfolio risk and correlation coefficient Priyanka is an inyestor who believes that past variability of stocks is a reasonably

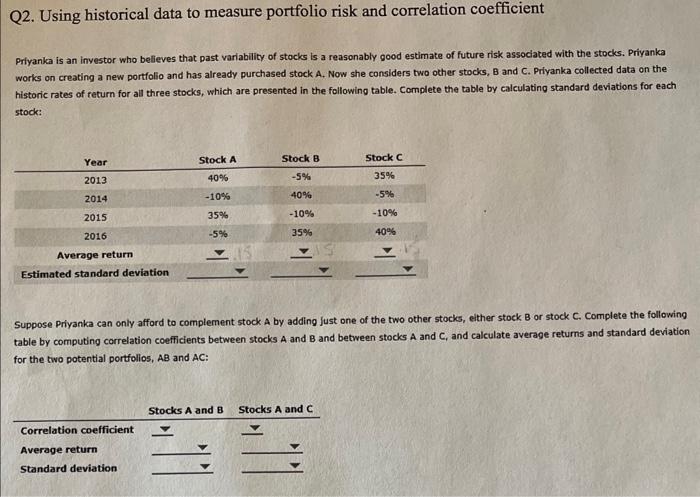

Q2. Using historical data to measure portfolio risk and correlation coefficient Priyanka is an inyestor who believes that past variability of stocks is a reasonably good estimate of future risk associated with the stocks. Priyanka works on creating a new portfolio and has already purchased stock A. Now she considers two other stocks, B and C. Priyanka collected data on the historic rates of return for all three stocks, which are presented in the following table. Complete the table by calculating standard deviations for each stock: Suppose Priyanka can only afford to complement stock A by adding Just one of the two other stocks, either stock B or stock C. Complete the following table by computing correlation coefficients between stocks A and B and between stocks A and C, and calculate average returns and standard deviation for the two potential portfolios, AB and AC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts