Question: q20 (Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from Nichols State University and is anxious to begin

q20

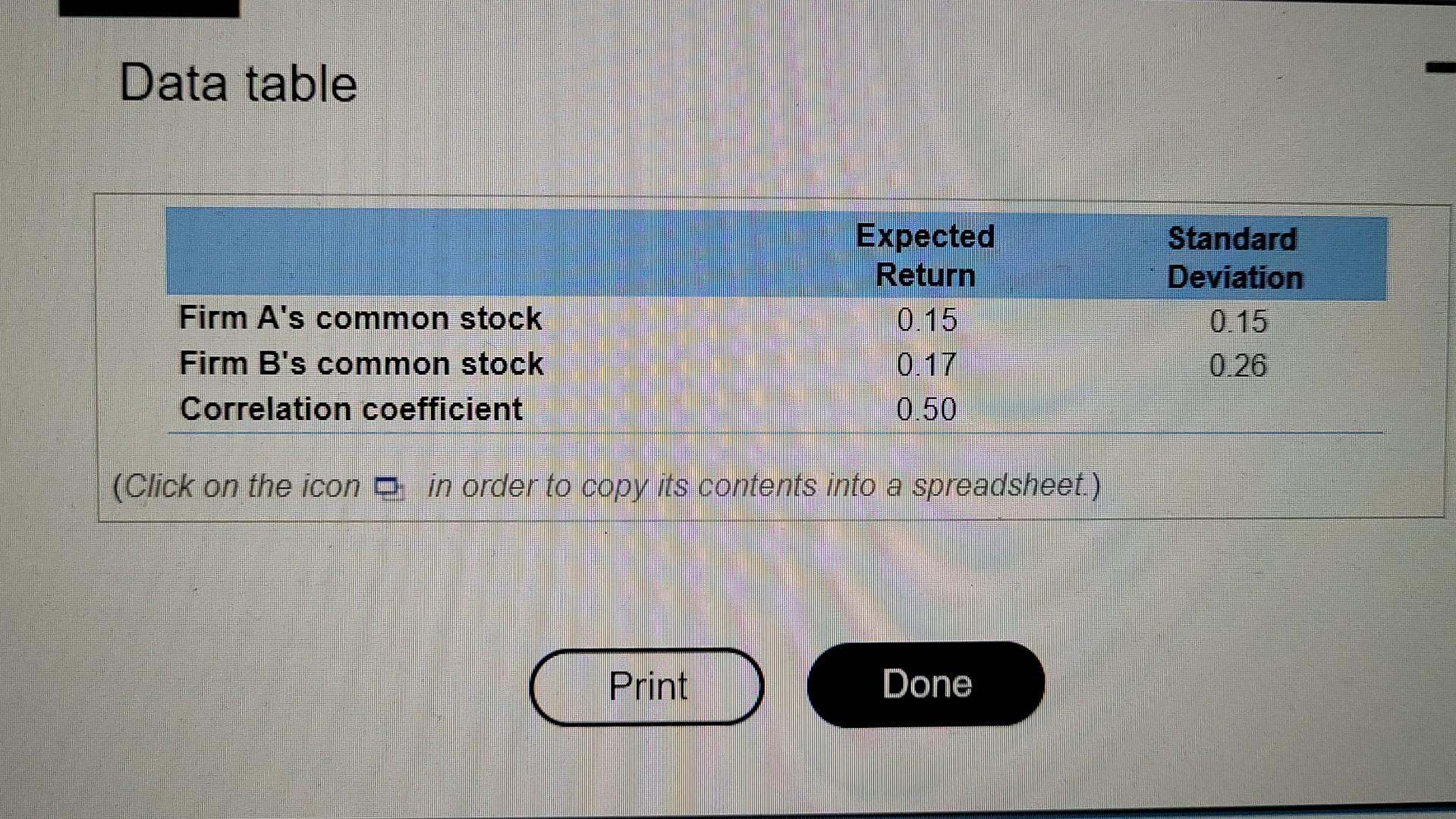

(Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from Nichols State University and is anxious to begin investing her meager savings as a way of stock of Firm A and Firm B: a. If Mary invests half her money in each of the two common stocks, what is the portfolio s expected rate of return and standard deviation in portfolio return? b. Answer part a where the correlation between the two common stock investments is equal to zero c. Answer part a where the correlation between the two common stock investments is equal to +1 d. Answer part a where the correlation between the two common stock investments is equal to -1 e. Using your responses to questions a-d, describe the relationship between the correlation and the risk and return of the portfolio. Data table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts