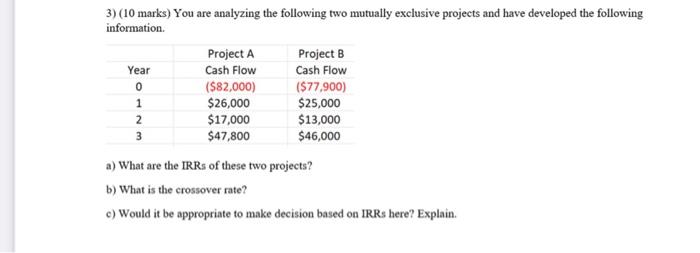

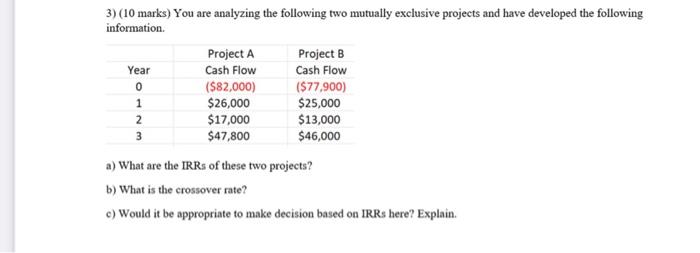

Question: Q3 Year 0 1 3) (10 marks) You are analyzing the following two mutually exclusive projects and have developed the following information Project A Project

Q3

Year 0 1 3) (10 marks) You are analyzing the following two mutually exclusive projects and have developed the following information Project A Project B Cash Flow Cash Flow ($82,000) ($77,900) $26,000 $25,000 2 $17,000 $13,000 3 $47,800 $46,000 a) What are the IRRs of these two projects? b) What is the crossover rate? c) Would it be appropriate to make decision based on IRRs here? Explain

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock