Question: Q5 Please answer the question clearly step by step, if there is a handwritten answer on paper, write it so it can be viewed clearly.

Q5

Please answer the question clearly step by step, if there is a handwritten answer on paper, write it so it can be viewed clearly.

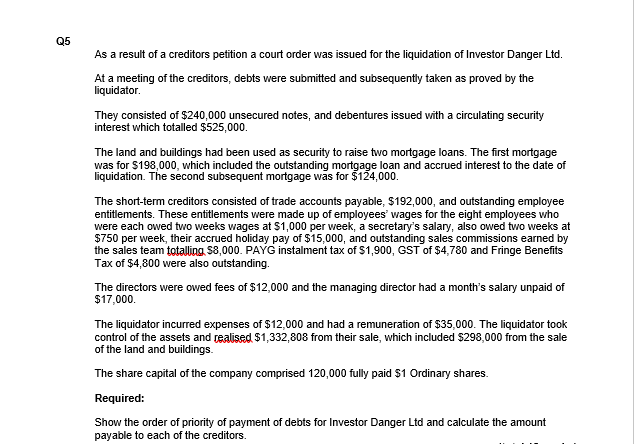

As a result of a creditors petition a court order was issued for the liquidation of Investor Danger Ltd. At a meeting of the creditors, debts were submitted and subsequently taken as proved by the liquidator. They consisted of $240,000 unsecured notes, and debentures issued with a circulating security interest which totalled $525,000. The land and buildings had been used as security to raise two mortgage loans. The first mortgage was for $198,000, which included the outstanding mortgage loan and accrued interest to the date of liquidation. The second subsequent mortgage was for $124,000. The short-term creditors consisted of trade accounts payable, $192,000, and outstanding employee entitlements. These entitlements were made up of employees' wages for the eight employees who were each owed two weeks wages at $1,000 per week, a secretary's salary, also owed two weeks at $750 per week, their accrued holiday pay of $15,000, and outstanding sales commissions earned by the sales team totaling $8,000. PAYG instalment tax of $1,900, GST of $4,780 and Fringe Benefits Tax of $4,800 were also outstanding. The directors were owed fees of $12,000 and the managing director had a month's salary unpaid of $17,000. The liquidator incurred expenses of $12,000 and had a remuneration of $35,000. The liquidator took control of the assets and realised $1,332,808 from their sale, which included $298,000 from the sale of the land and buildings. The share capital of the company comprised 120,000 fully paid $1 Ordinary shares. Required: Show the order of priority of payment of debts for Investor Danger Ltd and calculate the amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts