Question: Q5 QUESTION 5 Corporate Valuation Method (Harrison Airlines): What should be the company's stock price today? Corporate Valuation Method: Today is December 30, 2018. The

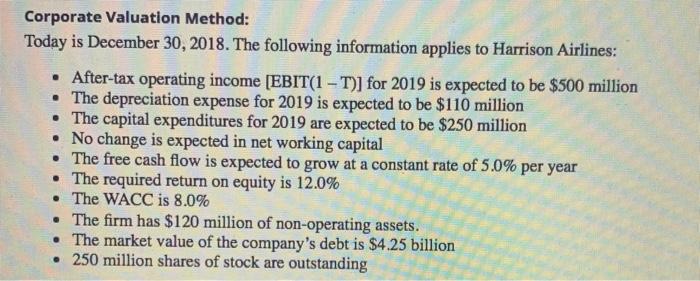

QUESTION 5 Corporate Valuation Method (Harrison Airlines): What should be the company's stock price today? Corporate Valuation Method: Today is December 30, 2018. The following information applies to Harrison Airlines: After-tax operating income (EBIT(1 - T)] for 2019 is expected to be $500 million The depreciation expense for 2019 is expected to be $110 million The capital expenditures for 2019 are expected to be $250 million No change is expected in net working capital The free cash flow is expected to grow at a constant rate of 5.0% per year The required return on equity is 12.0% The WACC is 8.0% The firm has $120 million of non-operating assets. The market value of the company's debt is $4.25 billion 250 million shares of stock are outstanding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts