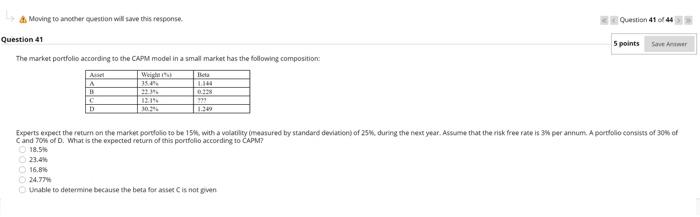

Question: Moving to another ton will save this response Question 41 of 44 Question 41 5 points for The market portfolio according to the CAPM model

Moving to another ton will save this response Question 41 of 44 Question 41 5 points for The market portfolio according to the CAPM model in a small market has the following composition ARSI Weiss Beta A 35. B 32 0.35 G D 30 Experts espect the return on the market portfolio to be 15%, with a volatility measured by standard deviation of 25. during the next year. Assume that the risk free vues 3% per annum. A portfolio consus of 30% of Cand 70% of D. What is the expected return of this portfolio according to CAPM? 18.5 16.87 24.774 Unable to determine because the beta forse is not en

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock