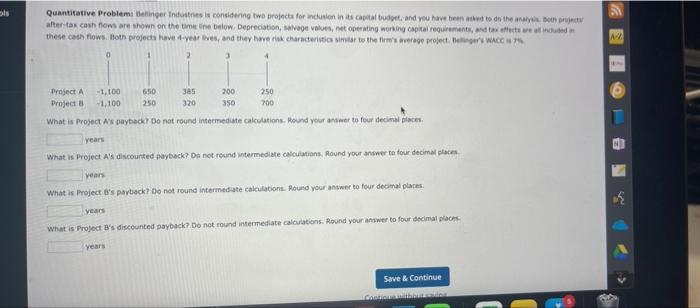

Question: Quantitative Problemi Bellinger Industries is considering two projects for induction in its capital buit and you have to do the word alter-tax cash flows are

Quantitative Problemi Bellinger Industries is considering two projects for induction in its capital buit and you have to do the word alter-tax cash flows are shown on the time in below. Depreciation, salvage values, net operating working Capital requirements, and a few minded these cath rows. Both projects and year wes, and they were characteristiciler to the firm's rape projecte WACC 0 Project A -1.100 650 385 200 250 Project -1,100 250 320 350 200 What is Project A's payback? Do not round intermediate calculations. Round your answer to four decimal places years What is Project A's discounted payback? Do not round intermediate calculations. Round your answer to four decimal places years What is Project B's payback? Do not round intermediate calculation. Round your answer to four decimal places years What is Project B's discounted payback? Do not round intermediate calculations. Round your answer to four decimal places Years Save & Continue v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts