Question: QUESTION 0 1 ( 0 5 points ) - Coefficient of Variation ( CV ) We need to compare volatility of multiple assets. As the

QUESTION points Coefficient of Variation CV

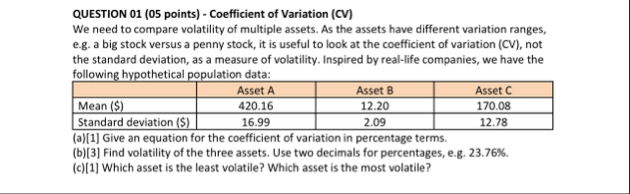

We need to compare volatility of multiple assets. As the assets have different variation ranges, eg a big stock versus a penny stock, it is useful to look at the coefficient of variation CV not the standard deviation, as a measure of volatility. Inspired by reallife companies, we have the following hypothetical population data:

tableAsset AAsset BAsset CMean $Standard deviation $

a Give an equation for the coefficient of variation in percentage terms.

b Find volatility of the three assets. Use two decimals for percentages, eg

c Which asset is the least volatile? Which asset is the most volatile?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock