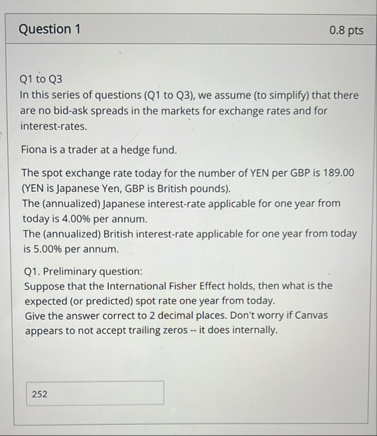

Question: Question 1 0 . 8 pts Q 1 to Q 3 In this series of questions ( Q 1 to Q 3 ) , we

Question

pts

Q to Q

In this series of questions Q to Q we assume to simplify that there are no bidask spreads in the markets for exchange rates and for interestrates.

Fiona is a trader at a hedge fund.

The spot exchange rate today for the number of YEN per GBP is YEN is Japanese Yen, GBP is British pounds

The annualized Japanese interestrate applicable for one year from today is per annum.

The annualized British interestrate applicable for one year from today is per annum.

Q Preliminary question:

Suppose that the International Fisher Effect holds, then what is the expected or predicted spot rate one year from today.

Give the answer correct to decimal places. Don't worry if Canvas appears to not accept trailing zeros it does internally.Question

pts

Q follows on from Q

Q:

Today, Fiona forms the view that the spot rate in one year from now will in her opinion or best guess or based on her hunch be expressed as number of YEN per GBP

In order to act on her hunch, Fiona needs to devise a trading strategy for her to make money if her hunch turns out to be correct.

She is authorized to borrow mio JPY as risk capital she has to repay this loan with interest in order to speculate in the market based on her hunch.

Assume Fiona has devised a correct and appropriate trading strategy to act on her hunch.

NB: For the sake of being definite, you are NOT to assume that the International Fisher Effect holds in Q and Q

Q: Suppose the spot rate one year from now indeed turns out to be as Fiona guessed YEN per GBP How many JPY does Fiona's company make in profit if the amount is a loss, enter with a minus sign

Give your answer in JPY to the nearest JPYQuestion

pts

This follows on from Q and uses the same market data.

Q: As an alternative to Q:

Suppose the spot rate one year from now turns out to be How many JPY does Fiona's company make in profit if the amount is a loss, enter with a minus sign Give your answer in JPY to the nearest JPY

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock