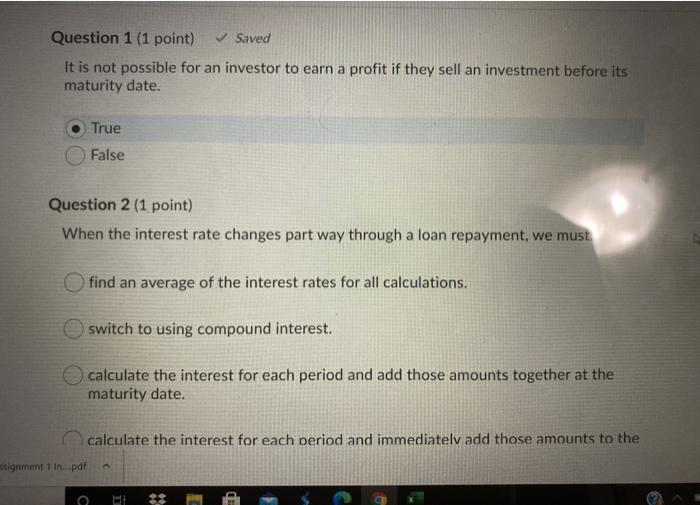

Question: Question 1 (1 point) Saved It is not possible for an investor to earn a profit if they sell an investment before its maturity date.

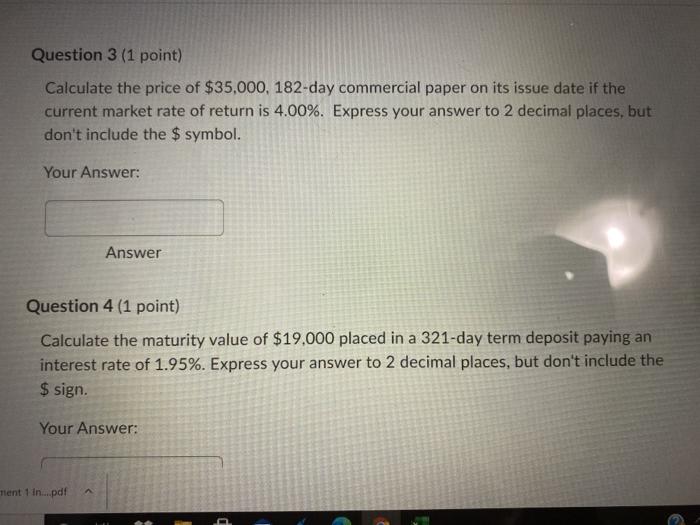

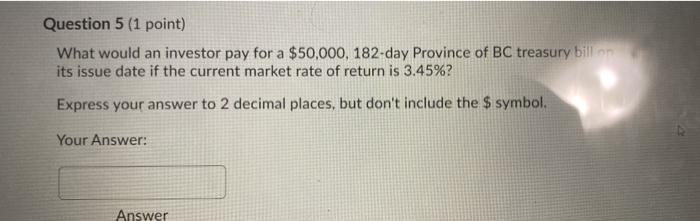

Question 1 (1 point) Saved It is not possible for an investor to earn a profit if they sell an investment before its maturity date. True False Question 2 (1 point) When the interest rate changes part way through a loan repayment, we must find an average of the interest rates for all calculations. switch to using compound interest. calculate the interest for each period and add those amounts together at the maturity date. calculate the interest for each period and immediatelv add those amounts to the ssignment 1 In.pdf Question 3 (1 point) Calculate the price of $35,000, 182-day commercial paper on its issue date if the current market rate of return is 4.00%. Express your answer to 2 decimal places, but don't include the $ symbol. Your Answer: Answer Question 4 (1 point) Calculate the maturity value of $19.000 placed in a 321-day term deposit paying an interest rate of 1.95%. Express your answer to 2 decimal places, but don't include the $ sign. Your Answer: ment 1 In....pdf Question 5 (1 point) What would an investor pay for a $50,000, 182-day Province of BC treasury bill on its issue date if the current market rate of return is 3.45%? Express your answer to 2 decimal places, but don't include the $ symbol. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts