Question: Question 1 (1 point) Saved There is an inverse relationship between bond credit ratings and the yield on a bond. The yield is highest for

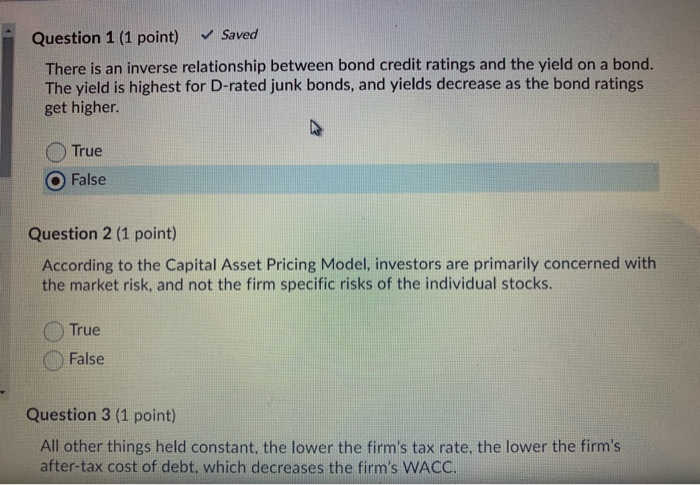

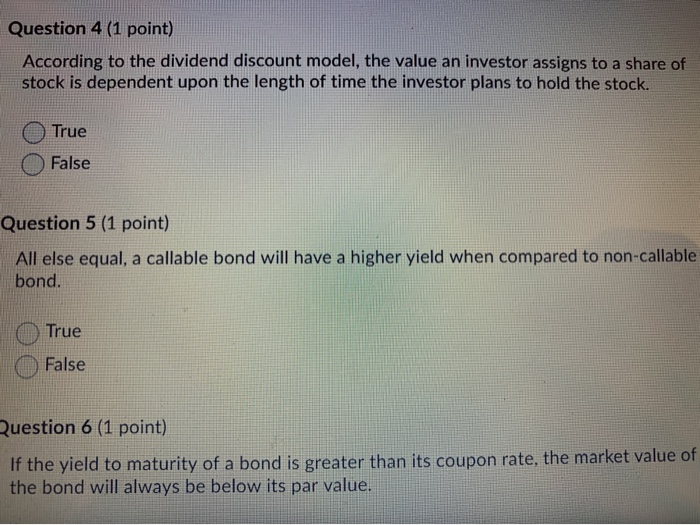

Question 1 (1 point) Saved There is an inverse relationship between bond credit ratings and the yield on a bond. The yield is highest for D-rated junk bonds, and yields decrease as the bond ratings get higher. True O False Question 2 (1 point) According to the Capital Asset Pricing Model, investors are primarily concerned with the market risk, and not the firm specific risks of the individual stocks. True False Question 3 (1 point) All other things held constant, the lower the firm's tax rate, the lower the firm's after-tax cost of debt, which decreases the firm's WACC. Question 4 (1 point) According to the dividend discount model, the value an investor assigns to a share of stock is dependent upon the length of time the investor plans to hold the stock. True False Question 5 (1 point) All else equal, a callable bond will have a higher yield when compared to non-callable bond. True False Question 6 (1 point) If the yield to maturity of a bond is greater than its coupon rate, the market value of the bond will always be below its par value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts