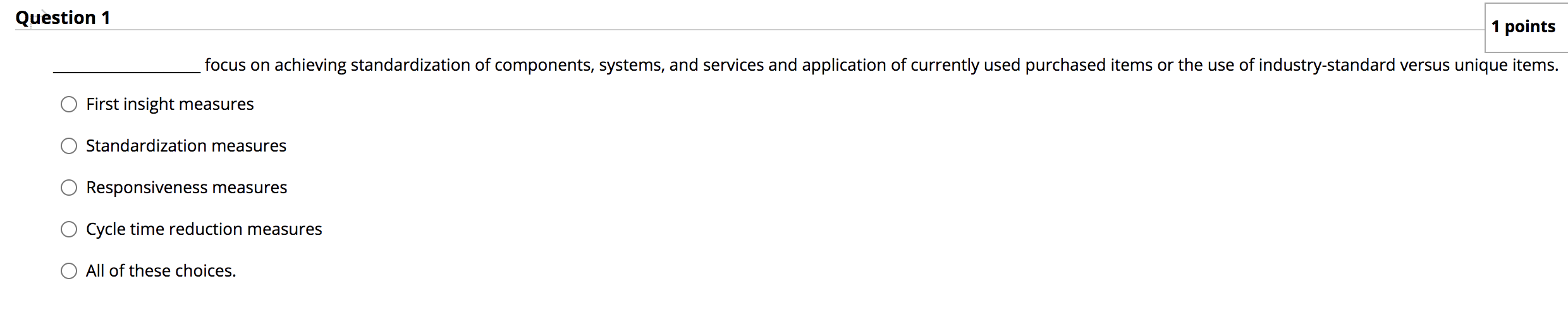

Question: Question 1 1 points focus on achieving standardization of components, systems, and services and application of currently used purchased items or the use of industry-standard

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock