Question: QUESTION 1 1 points Save Answer Beta coefficients 1. are a measure of systematic risk 2. relate the return on an individual security to the

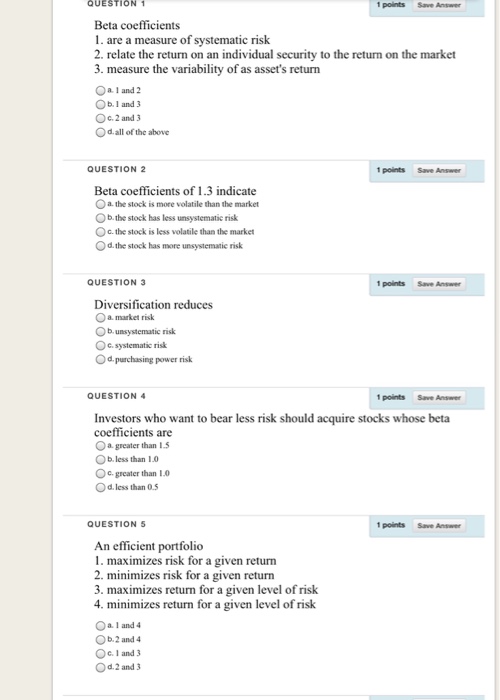

QUESTION 1 1 points Save Answer Beta coefficients 1. are a measure of systematic risk 2. relate the return on an individual security to the return on the market 3. measure the variability of as asset's retunn Oa. 1 and 2 Ob.I and 3 Oc. 2 and3 Od.all of the above QUESTION 2 1 points Save Answer Beta coefficients of 1.3 indicate Oa the stock is more volatile than the market Ob.the stock has less unsystematic risk C. the stock is less volatile than the market Od.the stock has more unsystematic risk QUESTION 3 1 points Save Answer Diversification reduces Oa. market risk Ob unsystematic risk Oe.systematic risk Od purchasing power risk QUESTION 4 1 points Save Answer Investors who want to bear less risk should acquire coefficients are Oa. greater than 1 Ob. less than 10 Oc. greater than 1.0 Od.less than O stocks whose beta QUESTION 5 1 points Save Answer An efficient portfolio 1. maximizes risk for a given return 2. minimizes risk for a given return 3. maximizes return for a given level of risk 4. minimizes return for a given level of risk O a 1 and 4 Ob.2 and 4 OG. 1 and 3 Od.2 and 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts