Question: Question 1 (16 marks) (1 mark) (a) Calculate the integer value of n if 258 v=0.06 = 111.63 (b) Consider a perpetuity where the first

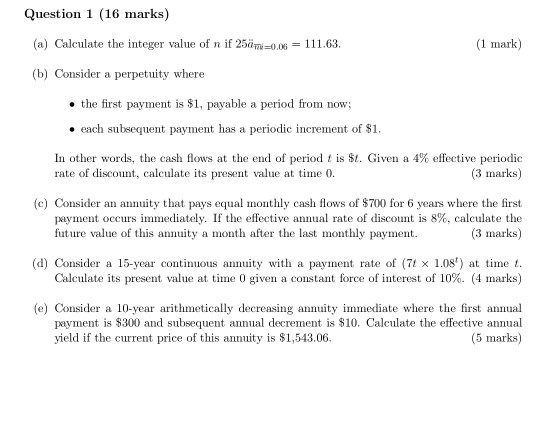

Question 1 (16 marks) (1 mark) (a) Calculate the integer value of n if 258 v=0.06 = 111.63 (b) Consider a perpetuity where the first payment is $1, payable a period from now; each subsequent payment has a periodic increment of $1. In other words, the cash flows at the end of period t is $t. Given a 4% effective periodic rate of discount, calculate its present value at time 0. (3 marks) (c) Consider an annuity that pays equal monthly cash flows of $700 for 6 years where the first payment occurs immediately. If the effective annual rate of discount is 8%, calculate the future value of this annuity a month after the last monthly payment. (3 marks) (d) Consider a 15-year continuous annuity with a payment rate of (74 x 1.08') at time t. Calculate its present value at time 0 given a constant force of interest of 10%. (4 marks) (e) Consider a 10-year arithmetically decreasing annuity immediate where the first annual payment is $300 and subsequent annual decrement is $10. Calculate the effective annual yield if the current price of this annuity is $1,543.06. (5 marks) Question 1 (16 marks) (1 mark) (a) Calculate the integer value of n if 258 v=0.06 = 111.63 (b) Consider a perpetuity where the first payment is $1, payable a period from now; each subsequent payment has a periodic increment of $1. In other words, the cash flows at the end of period t is $t. Given a 4% effective periodic rate of discount, calculate its present value at time 0. (3 marks) (c) Consider an annuity that pays equal monthly cash flows of $700 for 6 years where the first payment occurs immediately. If the effective annual rate of discount is 8%, calculate the future value of this annuity a month after the last monthly payment. (3 marks) (d) Consider a 15-year continuous annuity with a payment rate of (74 x 1.08') at time t. Calculate its present value at time 0 given a constant force of interest of 10%. (4 marks) (e) Consider a 10-year arithmetically decreasing annuity immediate where the first annual payment is $300 and subsequent annual decrement is $10. Calculate the effective annual yield if the current price of this annuity is $1,543.06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts