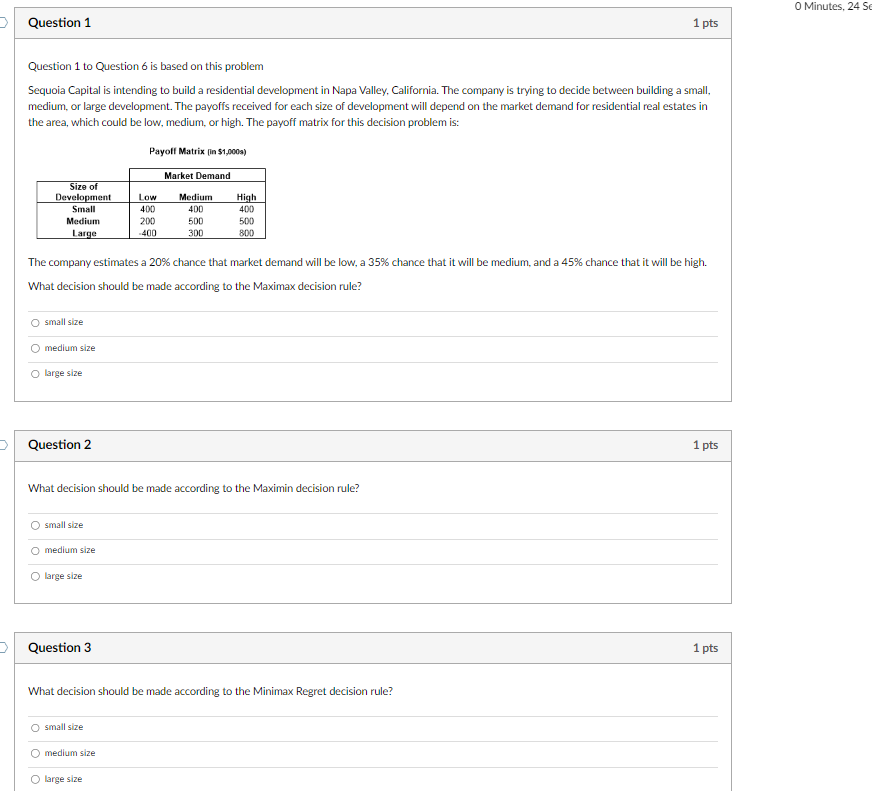

Question: Question 1 1pts Question 1 to Question 6 is based on this problem Sequoia Capital is intending to build a residential development in Napa Valley,

Question 1 1pts Question 1 to Question 6 is based on this problem Sequoia Capital is intending to build a residential development in Napa Valley, California. The company is trying to decide between building a small, medium, or large development. The payoffs received for each size of development will depend on the market demand for residential real estates in the area, which could be low, medium, or high. The payoff matrix for this decision problem is: Payolf Matrix [in \$1,000a) The company estimates a 20% chance that market demand will be low, a 35% chance that it will be medium, and a 45% chance that it will be high. What decision should be made according to the Maximax decision rule? Question 2 1 pts What decision should be made according to the Maximin decision rule? Question 3 1pts What decision should be made according to the Minimax Regret decision rule? small size medium size large size What decision should be made according to the EMV decision rule? small size medium size large size Question 5 1 pts What decision should be made according to the EOL decision rule? small size medium size large size Question 6 1 pts What is the expected value of perfect information? 175 200 385 440 a value different from all the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts