Question: Question 1, 2, 3 CASES Working towards Better Vision PARTN Essilor's Financial Performance LO Since 1992, Essilor had been the world leader income tive lenses

Question 1, 2, 3

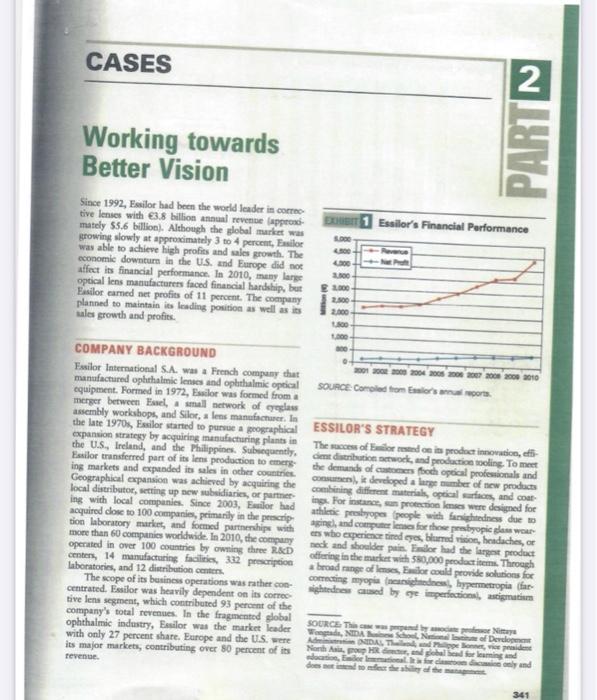

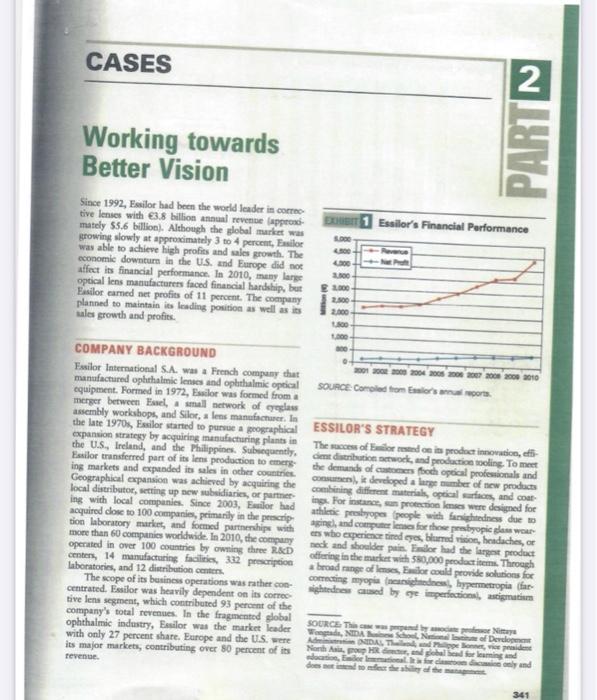

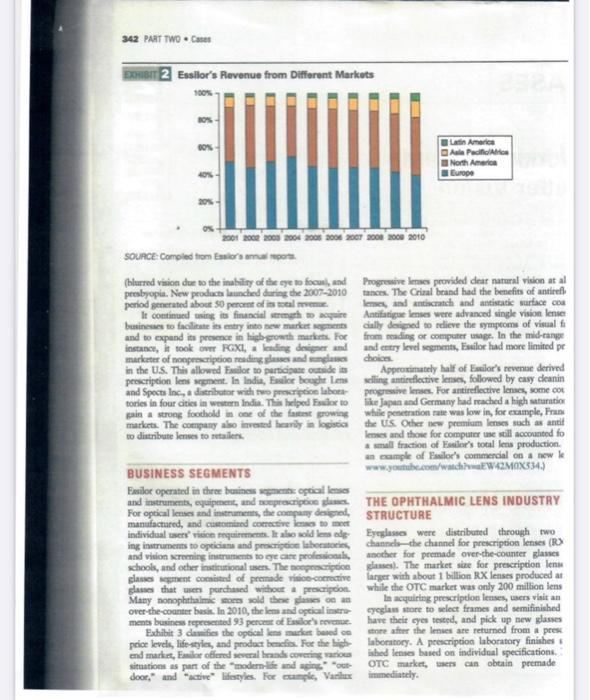

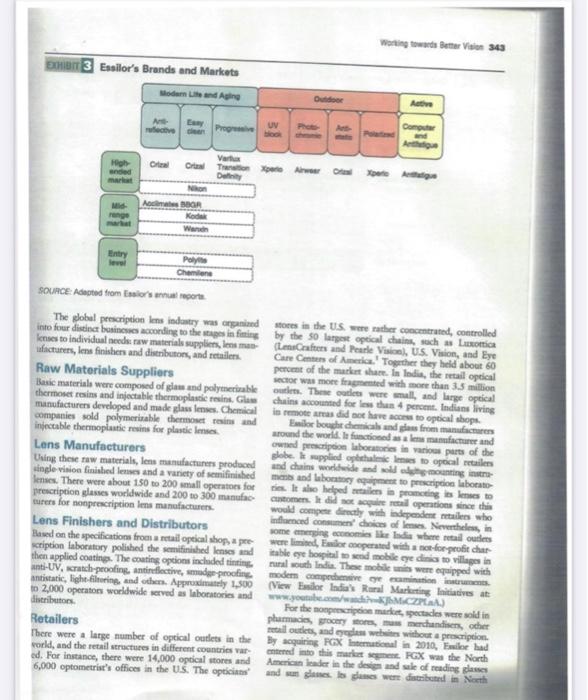

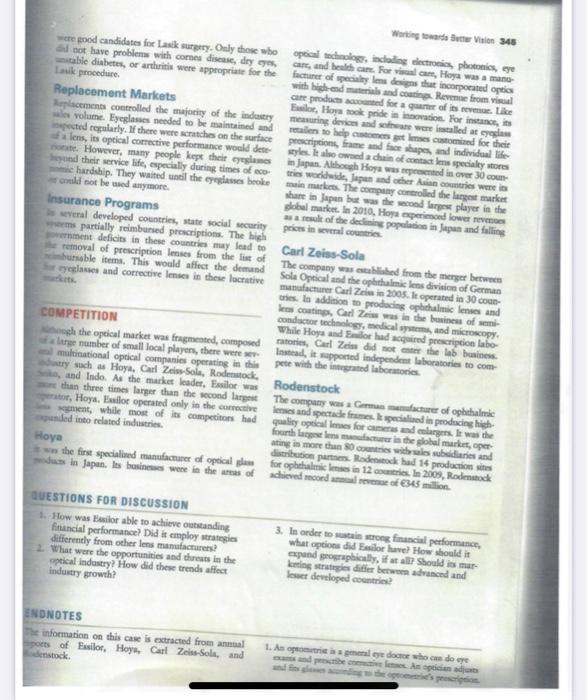

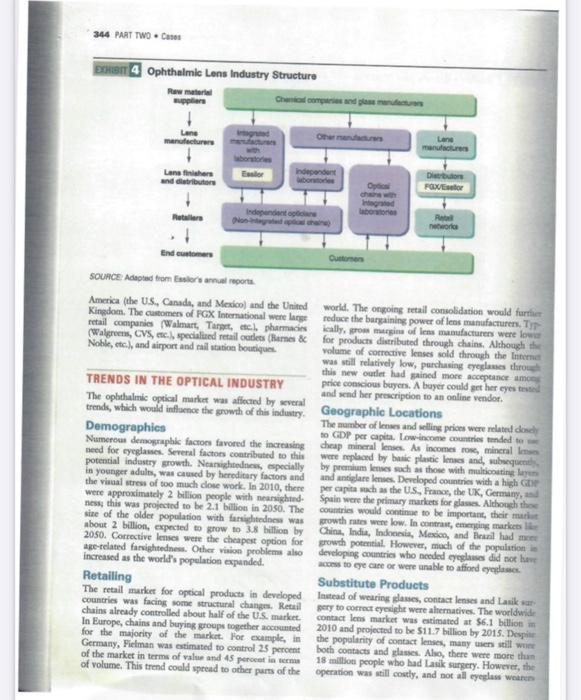

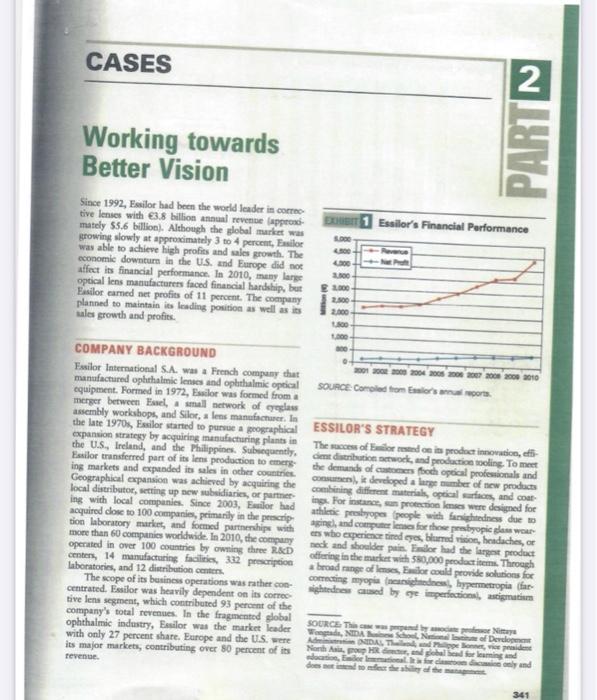

CASES Working towards Better Vision PARTN Essilor's Financial Performance LO Since 1992, Essilor had been the world leader income tive lenses with 3.8 billion annual revenue appro mately $5.6 billion. Although the global market was growing slowly at approximately 3 to 4 percentilor was able to achieve high profits and we growth. The economic downturn in the US and Europe did so affect is financial performance. In 2010, many large optical lens manufacturers faced financial hardship, but Psilor care se profits of 11 percent. The company planned to maintain ilding position as well as is sales growth and profiles Go 200 E 2000 2.500 2.000 SO . 100 2001 2000 2005 2006 2007 2008 2009 2010 SOURCE: Comedom o'r COMPANY BACKGROUND Essilor International SA was a French company that manufactured ophthalmic lenses and oplethalmic optical equipment. Formed in 1972, or was formed from a merger between Esselmal network of reglass assembly workshops, and Silor, a les manches the late 1970s, Essilor started to pursue a geographical expansion strategy by acquiring manufacturing plants in the US, Ireland, and the Philippines. Subsequently Essilor transferred part of its les production to merg ing markets and expanded its sales in other countries Geographical expansion was achieved by acquiring the local distributor, setting up new bidiaries, or armer ing with local companies. Since 2003, or hand acquired dose to 100 companie, primarily in the pencip tion laboratory market, and formed partnership with more than 60 companies worldwide. In 2010, the company operated in over 100 countries by owning three R&D centers, 14 manufacturing facilities, 332 prescription laboratories, and 12 distribution centers The scope of its business operations was rather co- centrated. Essilor was heavily dependent on its correc tive lens segment, which contributed 93 percent of the company's total revenues. In the fragmented global ophthalmic industry, Essilor was the market leader with only 27 percent share. Europe and the US. were its major markets, contributing over 80 percent of is revenue ESSILOR'S STRATEGY The success of product innovation, dient distribution work, and production ling. To meet the demands of confidopical professionals and con developed a large summer of new products combining different options, and a imgs. For instance, poctions were designed for athletic presbyopeople with fand does aing, and computers for those people es who experience tied yes, blurmed, headaches, neck and shoulder pain or had the largest product offering in the market with 580,000 peodem. Through a broad range of les could provide solutions for correcting myopie, hypermetropia far ghtede med byge imperfection again SOURCE TO Wagad, NDAN of Dersi NDALS Nahi Manding i El ocy and des the 341 342 PART TWO Cares 2 Essilor's Revenue from Different Markets 100% 10 Latin America Alle Pedido North America Europe % 20 2001 roce 2000 2000 2006 2007 2008 2009 2010 SOURCE: Compiled from Estors and report (blurred vision due to the inability of the eye to focus, and Progressive les provided dear natural vision at al presbyopit. New products launched during the 2007-2010 tances. The real band had the benefits of antire period generated about 50 percent of intele Iemes, and catch and antistatic surface coa It continued using its financial sermah apie Antifatigue les were advanced single vision lense businesses to facilisis entry into new markets cially designed to dieve the symptoms of visual and to expand its presence in high growth market for from reading or computer age. In the mid-range instance, it took over RCXI, leading designer and and try level segments, Essilor hund more limited pe marketer of nonprescription reading and choices in the U.S. This allowed For to participated is Approximately half of Escor's revente derived prescription lens ment. In India, bocht Lens selling antireflective Senses, followed by cay cleanin and Spects Inc, distributor with two prescription labor progressive lenses. For antireflective lenses, some cot tories in four cities in western India. The sto like Japan and Germany had reached a high ratio gain a strong foothold in one of the fastest growing while penetration was low in, for example, Frane market. The company also invested heavily in logistic the Us Other premium lenses such as anti to distribute lenses to en lenses and those for computere still accounted fo a small fraction of Flor's total lens production an emple of Flor's commercial on a new k BUSINESS SEGMENTS www.youtube.com/watchW42MOX334.) Fasilor operated in the business optical lenses and instruments, equipment, and represcripciones THE OPHTHALMIC LENS INDUSTRY For optical lenses and instruments, the company designed STRUCTURE manufactured, and customised commercielo to meet individuales vision requirements soldes de Eyeglasses were distributed through two ing instruments to opticians and praction about channesche channel for prescription lenses (R) and vision sering in ruments to professionalnother for premade over-the-counter glass schools, and other institutionales. The processes. The market size for prescription len glassment cost of premade corrective larger with about 1 billion RX lenses produced at glasses that we purchased without prescripcion. while the OTC market was only 200 million lens Many nonophthalmicores sold there was on an In acquiring prescription denses, es visitan over-the-counter basis. In 2010, the land optical cyeglass store to select frames and semifinished ments business reported 93 port of our have their eyes tested, and pick up new glasses Exhibit 3 danifies the optical market brede after the lies are returned from a press price levels, lifestyles, and product bem. For the labostory. A prescription laboratory finishes end marks, Free offered several hands covering various ished lenses based on individual specification situations as part of the modern lide und ging OTC market, ses can obtain premade door," and active lifestyles For sample, Vanlux immediately worting towards BV 343 3 Essilor's Brands and Markets odam und Od Ade Ewy UV Computer A High Var Cu Toner Dolny Arte M ABOR Warn Entry Jewel Poly Chem SOURCE: Adapted from Estos por The global prescription Ime industry was orgid so is the US weather and controlled into four distinct in ccording to the infig by the 50 largest optical chain socha Luxottica enses to individual needs raw materials supplies, mens and Padle Vision, US Vision, and Eye factures, Ims finishers and distributors, and retail Care Center of Tarther they bed about 60 Raw Materials Suppliers percent of the market share la India, the real optical Actor was more fragmented with more than 35 Basic materials were composed of glass and polymeable u. There were small and large optical thermoset resins and injectable thermoplastia Glowchains conted for the 4 percent. Indians living manufacturers developed and made glasses Chemical in remote amas did not have come to optical shops companies sold polymeritable thermost resin and obocht demand from injectable thermoplastic resins for plastic Imsex around the world and care and we prescription locatie was part of the Lens Manufacturers be applied ophaloocal tale Uring these raw materials, les manufactures produced and his wondering single vision finished less and a variety of semified mens and labo to prescriptio laborato lenses. There were about 150 200 small operators for is te helped me in promoting to prescription glasses worldwide and 200 - 300 mana customers. It al prossince the turers for nonprescription les manufacture would come directly with independent miles who inflamacio Nevesin Lens Finishers and Distributors some ging media where talu Based on the specification from a tal optical shoppe wereld, neperated with for profitar cription laboratory polished the semifinished lenses and le ce boiled mobile genito villages in then applied coating. The coating options included in un south India. The mobile repped with Anti-UV, catch-proofing antinctive, proting andam enpathai - iation - antistatic, light floring, and others. Approximately 1,500 (View de Indias Rural Marketing ves at 2,000 operators worldwide served as laboratories and www.o.com/MCPA) distributors For the precios mais pecades were sold in Retailers pharmacies ronyos merchandises other all outlets, and we without prescription There were a large number of optical outlets in the By acquiring FGX Interation in 2010, we had world, and the retail structures in different countries ar and to this market FX was the North ed. For instance, there were 14,000 optical stores and American leader in the designs and we of reading glass 6,000 optometrist's offices in the US. The opticians and some sewe died in North Working towards Vision 345 we good candidates for La surgery. Only those who spical clincoding vectronics, photonics, se not have problems with cores disease, dry eyes came, and health car. Forcat, Hoya was a mano table diabetes, or arthritis were appropriate for the face of specially designs that incorporated optis La procedure with hands and counting Revenge from visual care poated for a quarter of its revenue. Like Replacement Markets To, Hoy took pride in innovation. For instance, is placemento controlled the majority of the industry mening device and were called at gresia volume. Eyeglasses needed to be maintained and to con las costomid for their pected regularly there were scratches on the surface prescripcions, frame and freshapes, and individual life lens, its optical corrective performance would diese wyles. It also wanda chain of contact me specialty stores t. However, many people kept their eyeglames in Japan. Although Hoya was pred in over 30 com yond their service life, especially during times of ries worldwide, Japan and other Antries were is hardship. They waited until the glasses broke mai mare. The company controlled the largest market old not be used anymore share in Japan but the second largest player in the obal market. In 2010. Hoy experimeed lower even Insurance Programs a of the declining population in Japan and falling several developed countries, state social security prices in a contri am partially reimbursed prescriptions. The high ernment deficits in these countries may lead to Carl Zeiss-Sola removal of prescription les from the list of hunable items. This would affect the demand The company washed from the merger between Sole Optical and the optimic lens division of German glasses and correctives in these locatie manufacturer Carl Zein 2005. Le operated in 30 coun tries. In addition to producing ophthalmic lenses and scoutings, Carl Zwas in the business of semi COMPETITION conductor technolog, medical systems, and microscopy While Hoya and had acquired prescription labo h the optical market was fragmented, composed ories, Carl Zeiss did not the tab business a number of small local players, there were Inedit apported independent laboratories to com multinational optical companies operating in this pete with the laboratori y socha Hoya, Carl Z Sols, Rodenstock, and Indo. As the market leader, or was Rodenstock than three times larger than the second largest The company w Gamacher of ophthalmic , Hoya. Ewo operated only in the corrective es and spectacle specified in producing high ment, while most of its competitors had quality options for comes and larges. It was the unded into related industri fourth lagi the global market, oper ating more than 30 coisas subsidiaries and Hoye distribution para Rodock had 16 productions the first specialized manufacture of optical for ophalen 12. In 2009, Rodenstock de in Japan, les bains were in the of ievedmcord ca 345 million QUESTIONS FOR DISCUSSION 1. How was asilor able to achieve outstanding financial performance? Did it employ strategies differently from other les muntacturers? 2. What were the opportunities and there in the ptical industry? How did these trends affect industry growth? 3. In order to sustain strong financial performance, what options de fave? How should it expand geographically if a Should is mer ring strategies de between danced and Ist developed countries ENDNOTES The information on this case is extracted from annual ports of El Hoy, Carl Zeiss-Sole, and denstock 1. Arsenal y doce who came degre An pics 344 PART TWO Cases B Ophthalmic Lens Industry Structure Raw material Channes wir manufacturer Onun Land man Lanthers and tributor independent bor FOX Opis ng labore Independent R End Quito SOURCE Aded from salos America (the US, Canada, and Medico) and the United world. The ongoing retail consolidation would further Kingdom. The customers of PGX International were large reduce the bargaining power of lens manufacturers, Ty retail companies Walmart, Tanget, le pharmaciseally grow mugime of lens manufacturers were low (Walgreens, CVS, especialued retail codes Bares & for products distributed through chains. Although the Noble, etc.) and airport and mail station boutique volume of corrective lenses sold through the Internet was still relatively low, purchasing eyeglasses throw this new det had gained more acceptance amo TRENDS IN THE OPTICAL INDUSTRY price conscious buyers. A buyer could get her eyes tested and send her prescription to an online vendor The ophthalmic optical market was affected by several tred, which would influence the growth of this industry. Geographic Locations The number of less and selling prices were related doch Demographics to GDP per capita, Low-income countries anded to Numerous demographic factors favored the increasing cheap mineralles. As income on, mineral need for seglame. Several factors contributed to this were replaced by a plastic and subsequent potential industry growth. Nende specially by premium sach as those with multicely in younger adules, was used by hereditary factors and and antiglare mes Developed countries with a high the vial stress of too much dose work. In 2010, there per capita ch as the US, France, the UK, Germany were approximately 2 billion people with ansighed Spain were the primary markets for glass. Although the ness, this was projected to be 2.1 billion in 2050. The countries would continue to be important their mais site of the older population with frightedness was growth rates were low. In conting markets about 2 billion, expected to grow to 38 Willion by China, India, Indonesia, Media, and Bellad 2050. Corrective lenses were the cheapest option for growth potential. However, much of the population age-related farsightedness. Other vision problems alto developing countries who needed reglas did not have increased as the world's population expanded. co to eye cate or were unable to afford og Retailing Substitute Products The retail market for optical products in developed instead of wearing classes, contact lenses and Lasikan countries was facing some structural change. Retail pery to correct eyesight were alternatives. The worldwide chains already controlled about half of the U.S. market contact lens market was estimated at $6.1 billion In Europe, chains and buying groups together counted 2010 and projected to be $11.7 billion by 2015. Despite for the majority of the market. For emple, in the popularity of contact lenses, many uses still wore Germany, Fielman was estimated to control 25 percent both contacts and classes. Also, there were more than of the market in terms of value and 45 proti 18 million people who had Lasik surgery. However, the of volume. This trend could spend to other parts of the operation was still costly, and not all eyeglass wenn