Question: Question 1 (21 Marks} An organization is examining ve mutually exclusive alternatives; Alpha, Beta, Gamma, Delta, and Epsilon. You can assume that each alternative represents

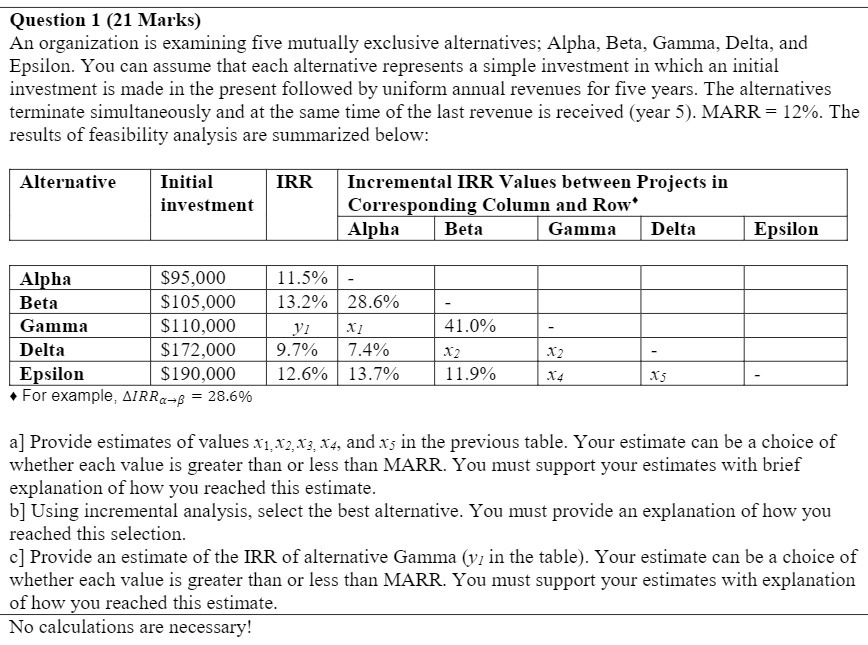

Question 1 (21 Marks} An organization is examining ve mutually exclusive alternatives; Alpha, Beta, Gamma, Delta, and Epsilon. You can assume that each alternative represents a simple investment in which an initial investment is made in the present followed by uniform annual revenues for ve years. The alternatives terminate simultaneously and at the same time of the last revenue is received (year 5). MARK = 12%. The results of feasibility analysis are summarized below: Initial investment Alternative Incremental [RR Values between Projects in Corresponding Column and Row' Epsilon $190,000 Alpha $95,000 11.5% Beta $105,000 13.2% Gamma $110,000 y; Delta $172,000 9.7% x 2 x2 ' 116% o For example, HERE'S = 28.6% a] Provide estimates of values x1=xglx3= x4, and I5 in the previous table. Your estimate can be a choice of whether each value is greater than or less than MARK. You must support your estimates with brief explanation of how you reached this estimate. b] Using incremental analysis, select the best alternative. You must provide an explanation of how you reached this selection. c] Provide an estimate of the IRR of alternative Gamma (y; in the table}. Your estimate can be a choice of whether each value is greater than or less than MARE. You must support your estimates with explanation of how you reached this estimate. No calculations are necessary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts