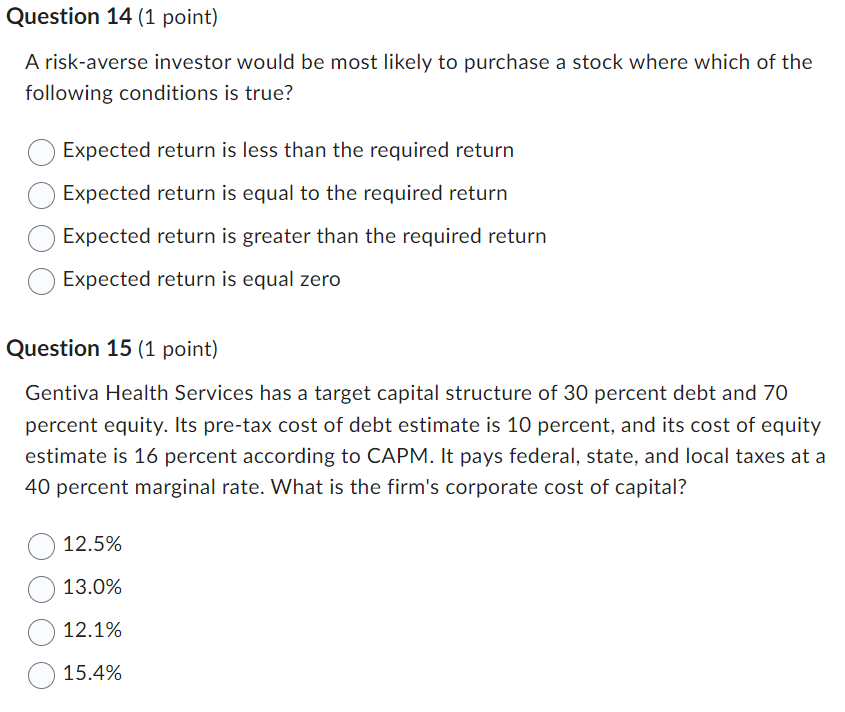

Question: Question 1 4 ( 1 point ) A risk - averse investor would be most likely to purchase a stock where which of the following

Question point

A riskaverse investor would be most likely to purchase a stock where which of the

following conditions is true?

Expected return is less than the required return

Expected return is equal to the required return

Expected return is greater than the required return

Expected return is equal zero

Question point

Gentiva Health Services has a target capital structure of percent debt and

percent equity. Its pretax cost of debt estimate is percent, and its cost of equity

estimate is percent according to CAPM. It pays federal, state, and local taxes at a

percent marginal rate. What is the firm's corporate cost of capital?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock