Question: Question 1 4 ( 2 0 marks ) Mr Cheung is single and is under employment in Hong Kong on a monthly salary of $

Question marks

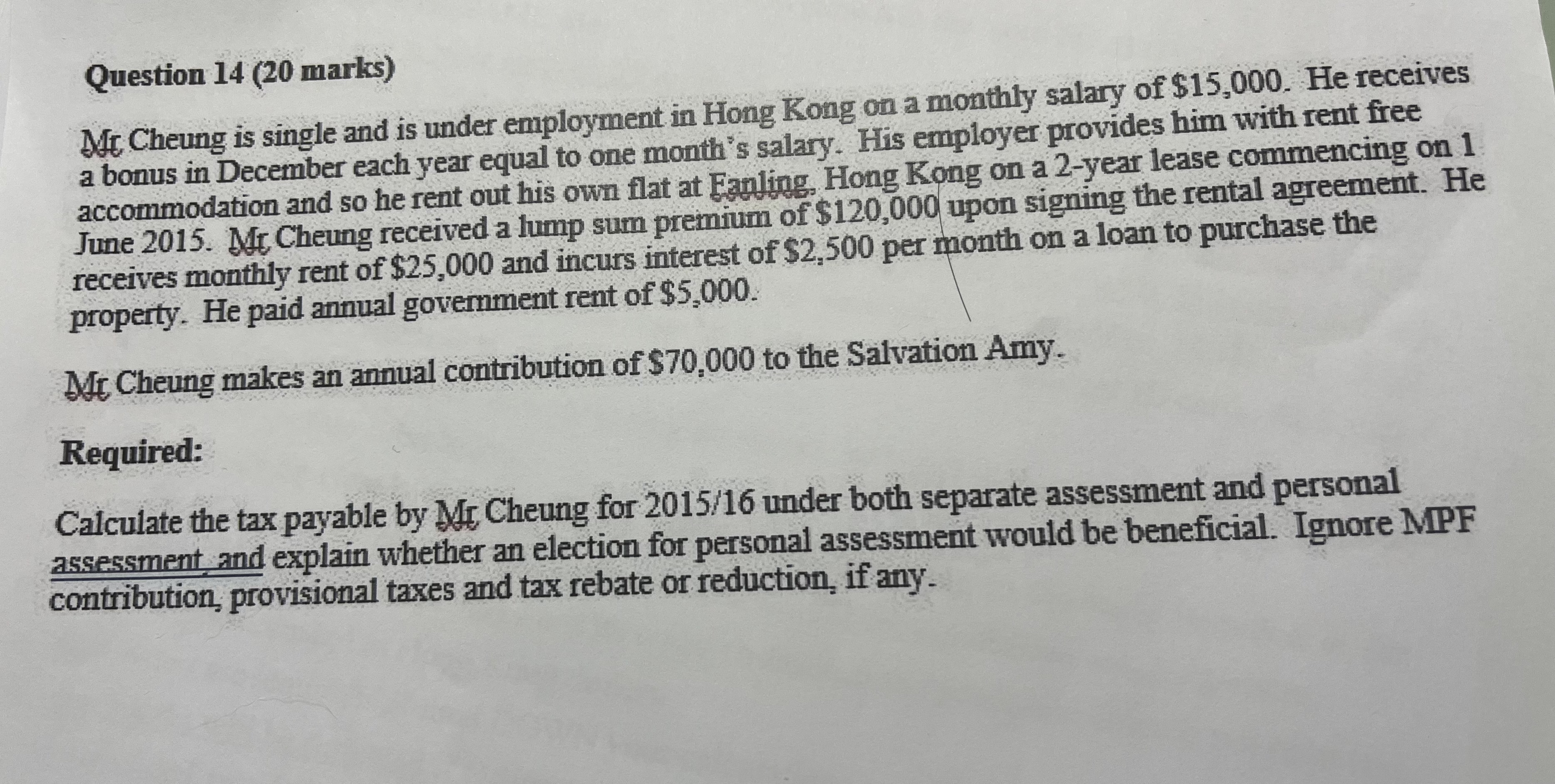

Mr Cheung is single and is under employment in Hong Kong on a monthly salary of $ He receives a bonus in December each year equal to one month's salary. His employer provides him with rent free accommodation and so he rent out his own flat at Eanling. Hong Kong on a year lease commencing on June Mt Cheung received a lump sum premium of $ upon signing the rental agreement. He receives monthly rent of $ and incurs interest of $ per month on a loan to purchase the property. He paid annual government rent of $

Mt Cheung makes an annual contribution of $ to the Salvation Amy.

Required:

Calculate the tax payable by Mr Cheung for under both separate assessment and personal assessment, and explain whether an election for personal assessment would be beneficial. Ignore MPF contribution, provisional taxes and tax rebate or reduction, if any.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock