Question: Question 1 8 ( 8 . 5 points ) Listen ( HINT , THIS QUESTION IS NOT THAT DIFFICULT ) Your firm has a market

Question points

Listen

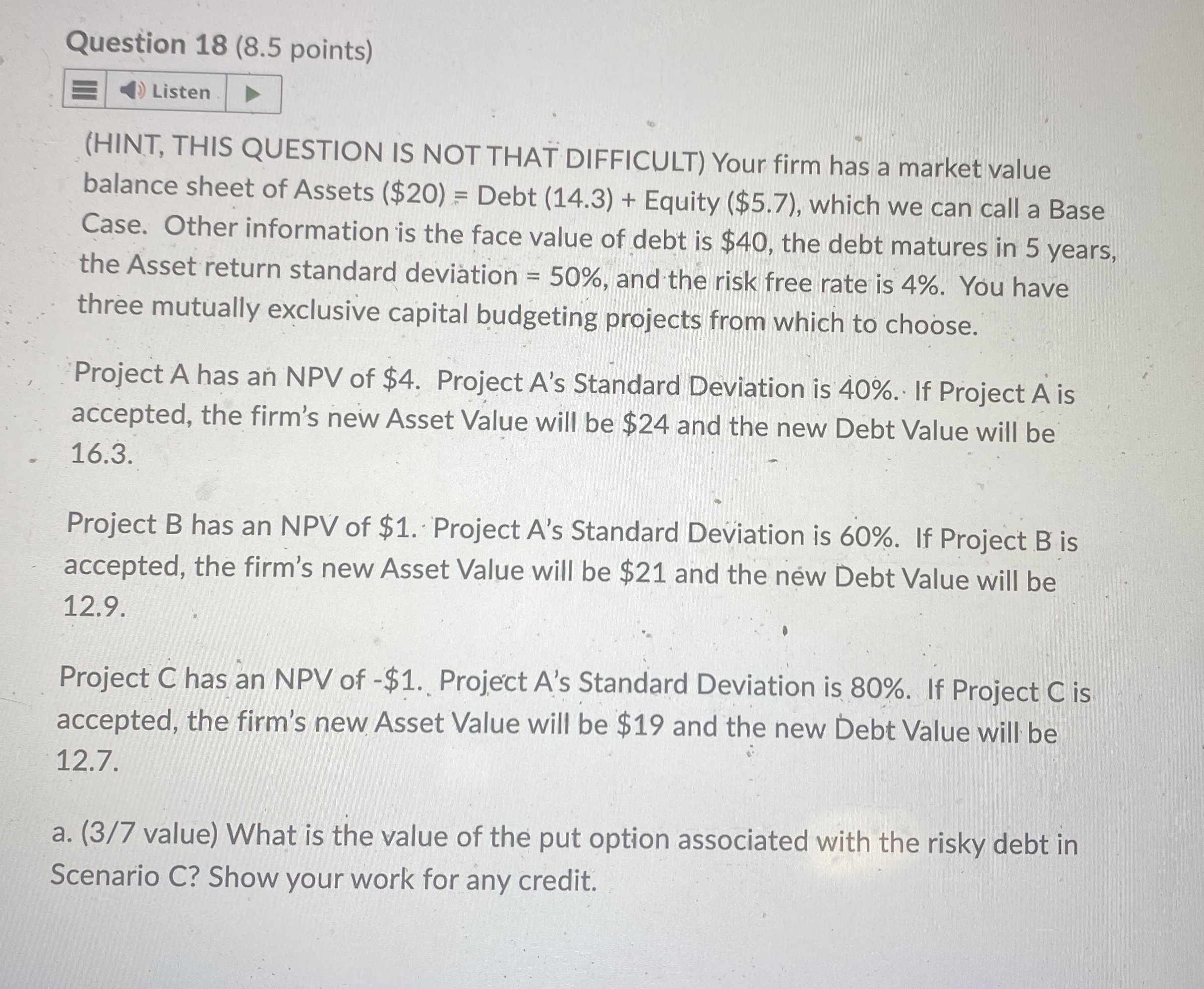

HINT THIS QUESTION IS NOT THAT DIFFICULT Your firm has a market value balance sheet of Assets $ Debt Equity $ which we can call a Base Case. Other information is the face value of debt is $ the debt matures in years, the Asset return standard deviation and the risk free rate is You have three mutually exclusive capital budgeting projects from which to choose.

Project A has an NPV of $ Project As Standard Deviation is If Project is accepted, the firm's new Asset Value will be $ and the new Debt Value will be

Project B has an NPV of $ Project As Standard Deviation is If Project B is accepted, the firm's new Asset Value will be $ and the new Debt Value will be

Project has an NPV of $ Project As Standard Deviation is If Project is accepted, the firm's new Asset Value will be $ and the new Debt Value will be

a value What is the value of the put option associated with the risky debt in Scenario C Show your work for any credit.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock